Liveblog Archief woensdag 27 januari 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Rentevoetbeslissing | Actueel: 0,25% Verwacht: 0,25% Vorige: 0,25% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -9,910M Verwacht: 0,430M Vorige: 4,351M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Kern Duurzame Goederen Bestellingen (Maandelijks) (Dec) | Actueel: 0,7% Verwacht: 0,5% Vorige: 0,8% |

Markt snapshot Wall Street vandaag

TOP NEWS

• Fed on hold as officials weigh pandemic against vaccines, fiscal support

The Federal Reserve is expected to keep U.S. monetary policy locked in crisis-fighting mode at its meeting ending on Wednesday as policymakers assess an economy still struggling through the shock of a pandemic but looking forward to relief from ongoing vaccinations and new government spending plans.

PREVIEW-Wall Street expects near-record iPhone sales despite delay, shut Apple stores

During the last three months of 2020, Apple delivered its flagship iPhone 12 model weeks later than normal iPhone debuts and shuttered some of its stores due to the pandemic. But Wall Street is still expecting a near-record sales quarter for the Cupertino, California company's signature device when it reports fiscal first-quarter earnings

• AT&T quarterly postpaid phone additions jump on 5G boost

AT&T said it added more postpaid phone subscribers than expected during the fourth quarter, helped by an uptick in demand for its 5G services as people continued to work from home following fresh pandemic curbs.

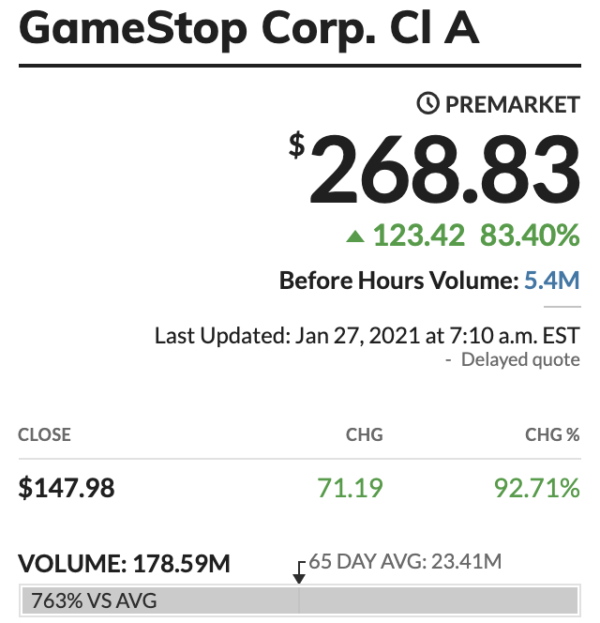

• GameStop stock doubles again with no let-up in amateur interest

Shares of videogame retailer GameStop surged in pre-market trading as amateur investors continued to pile into the stock that has skyrocketed nearly 700% over the past two weeks.

• Anthem sees negative impact to 2021 profit due to COVID-19

Health insurer Anthem said it expects a small hit to its full-year adjusted profit, partly due to COVID-19 impact on its business that sells government-backed Medicare plans.

BEFORE THE BELL

Wall Street futures were in the red, ahead of the Federal Reserve’s policy decision, due later in the day. European stocks dipped due to losses in technology and mining sectors. Japan’s Nikkei closed higher, on hopes of better corporate results after the International Monetary Fund raised its forecast for global growth. Gold prices slipped as the dollar climbed, while investors awaited further clarity on U.S. monetary stimulus. Oil prices were steady after industry data showed U.S. crude inventories fell unexpectedly. U.S. durable goods data is expected later in the day. Apple and Facebook are scheduled to report results after market’s close.

STOCKS TO WATCH

Results

• Advanced Micro Devices Inc: The company on Tuesday beat quarterly revenue estimates and forecast robust 2021 sales on strong demand for its chips used in PCs, data centers and gaming consoles from companies and customers adapting to remote working. The company projected first-quarter revenue to be about $3.2 billion, plus or minus $100 million, compared to analysts' average estimate of $2.74 billion. AMD forecast 2021 sales of $13.37 billion, above analysts' estimates of $12.28 billion. AMD's Chief Executive Su, in a conference call, said that AMD thinks console chip sales will be above normal levels in the first quarter, when they typically decline after the holiday shopping season in many parts of the world. She said she expects the tightness of overall AMD chip supplies to ease somewhat in the second half of the year.

• AT&T Inc: The company said it added more postpaid phone subscribers than expected during the fourth quarter, helped by an uptick in demand for its 5G services as people continued to work from home following fresh pandemic curbs. The company added 800,000 net new postpaid phone subscribers during the quarter. Analysts had expected AT&T to add 475,300 customers, according to research firm FactSet. Revenue in AT&T's HBO business rose 11.7% to $1.9 billion, driven by a growth in subscription revenue. The company reported a net loss attributable of $13.88 billion, or $1.95 per share in the fourth quarter. Total operating revenue was $45.69 billion, beating analysts' estimates of $44.56 billion.

• Anthem Inc: The health insurer said it expects a small hit to its full-year adjusted profit, partly due to COVID-19 impact on its business that sells government-backed Medicare plans. The company forecast adjusted profit of over $24.50 per share for the year 2021 and an operating revenue of about $135.1 billion. Anthem expects its benefit expense ratio, the share of premiums paid for medical services, to be in the range of 88%, plus or minus 50 basis points. The company's benefit expense ratio improved to 88.9% in the fourth quarter from 89% a year earlier. Excluding items, Anthem earned $2.54 per share, compared to analysts' estimate of $2.52. Net income fell to $551 million, or $2.19 per share from $934 million, or $3.62 per share, a year earlier.

• Canadian National Railway Co: The company said on Tuesday it aims to deliver high single-digit earnings per share growth in fiscal 2021 and beat quarterly profit as improvement in consumer spending drove volumes. The company's operating ratio, a closely watched measure of operating expenses as a percentage of revenue, fell to 61.4% from 66%. A higher ratio represents inefficiency. On an adjusted basis, Canadian National earned C$1.43 per share, topping analysts' average estimate of C$1.41. Revenue rose to C$3.66 billion from C$3.58 billion, a year earlier. Analysts on average expect earnings of C$6.29 per share for full-year 2021. Net income at the largest railroad operator in Canada rose to C$1.02 billion, or C$1.43 per share, in the quarter, from C$873 million, or C$1.22 per share, a year earlier.

• LG Display Co Ltd: The company reported its highest quarterly profit in over three years, with help from increased shipments of Apple's new iPhones. The Apple supplier posted an operating profit of 685 billion won ($622 million) in the fourth quarter of 2020, compared with a loss of 422 billion won in the same period a year earlier. It was the company's highest quarterly profit since the second quarter of 2017, and soundly ahead of market expectations for a 286 billion won profit. Stronger iPhone sales should spill over into LG Display's first quarter result, analysts said. Revenue rose 16% to 7.5 trillion won, LG Display said in a regulatory filing.

• Microsoft Corp: The company on Tuesday reported its Azure cloud computing services grew 50%, the second quarter of acceleration in a business that had begun to slow as the global pandemic benefited the software maker's investment on working and learning from home. On a conference call with investors, Microsoft executives said they expect a midpoint of $14.83 billion in revenue from the company's "Intelligent Cloud" segment for the fiscal third quarter, compared with Wall Street expectations of $14.12 billion. Microsoft said revenue in its "Intelligent Cloud" segment rose 23% to $14.6 billion, with 50% growth in Azure. LinkedIn revenue growth, which dipped as the pandemic shut down businesses, reached 23%, near its pre-pandemic rate of 24% a year earlier. Microsoft's gaming business topped $5 billion in quarterly sales for the first time ever and was propelled by gaming subscriptions and sales as well as new consoles. Microsoft said Xbox content and services revenue grew 40% in the quarter.

• Starbucks Corp: The company on Tuesday reported a larger-than-expected fall in quarterly sales as the renewed surge in coronavirus cases in the United States kept customers at home. The world's largest coffee chain's global same-store sales fell 5% in its first quarter, more than analysts' estimates of a 3.4% decline. Comparable sales declined 6% for the Americas region, compared with a 5.2% fall expected by analysts. But in China, Starbucks' biggest growth market, comparable sales rose 5% as the company benefited from the popularity of its rewards program and the return of pre-coronavirus consumer habits. Starbucks also said Chief Operating Officer Roz Brewer would be leaving the company next month to take a chief executive officer role at another company. For the second quarter, Starbucks said it expects U.S. comparable sales to rise between 5% and 10%, while in China they were forecast to grow nearly two-fold a year after the pandemic hit the region.

• Texas Instruments Inc: The company forecast current-quarter revenue above Wall Street estimates on Tuesday, expecting sales growth for a third straight quarter after two years of decline, buoyed by strong chip demand from the personal electronics market. Chip sales to personal electronics market jumped 39%, driven by consumers splurging on laptops and tablets to aid remote work and learning. TI expects first-quarter revenue in a range of $3.79 billion to $4.11 billion, above analysts' expectations of $3.59 billion. Net income rose to $1.69 billion, or $1.80 per share, in the fourth-quarter, from $1.07 billion, or $1.12 per share, a year earlier. Total revenue rose to $4.08 billion from $3.35 billion a year earlier, above Wall Street estimates of $3.6 billion.

Moves

• Walgreens Boots Alliance Inc & Starbucks Corp: Walgreens said on Tuesday it named Roz Brewer, the outgoing chief operating officer of Starbucks, as the company's chief executive officer. Brewer will take office from March 15. She succeeds Stefano Pessina, who will transition to the role of executive chairman of the Walgreens board, the drugstore chain said in a statement. Pessina served as CEO of the company for six years following the merger of Walgreens and Alliance Boots in December 2014. Walgreens said in July that Pessina was going to step down. Pessina will replace James Skinner as executive chairman of Walgreens in March. Skinner will remain on the board as a non-executive director to facilitate a leadership transition, the company said.

In Other News

• Alphabet Inc: Google is reviving plans to launch its own news website in Australia within weeks, according to a local media outlet contracted to provide articles for the venture, as the search giant fights world-first proposed laws on content payments. The launch of the News Showcase product as early as next month is Google's latest tactic in a high-profile campaign against the Australian government's planned legislation to make the company pay local news providers for content that appears in its search engine. Misha Ketchell, editor of the academic-penned newsite The Conversation, said he was approached by Google "to resume discussions about launching the News Showcase product as soon as possible, potentially in February. We are working with them on this".

• Amazon.com Inc: The online shopping platform is preparing to set up a Polish based website so local shoppers will no longer have to order via its German site, it said, sending shares in top local rival Allegro down by over 7%. Amazon has been present in Poland since 2014 with nine logistics centres but customers have had to order via its international websites, adding to costs. Local media have reported for months that the group was preparing to launch a local online shopping platform.

• AstraZeneca PLC: The European Union is asking the company to publish the contract it signed with the bloc on COVID-19 vaccine supplies, an EU official said, in an escalation of the row over delivery delays. The company pulled out of a meeting with the European Union scheduled, the official said. In an interview with newspapers on Tuesday, AstraZeneca CEO Pascal Soriot said the EU contract was based on a best-effort clause and did not commit the company to a specific timetable for deliveries.

• AT&T Inc: The company was sued on Tuesday for at least $1.35 billion by a Seattle company that accused the telecommunications giant of stealing its patented "twinning" technology, which lets smart devices such as watches and tablets respond to calls placed to a single phone number. Network Apps LLC said AT&T abandoned joint development and licensing agreements for its technology in 2014 after realizing it would owe a "fortune" in royalties because the market for smart devices was exploding, only to then incorporate the technology a year later in its own product, NumberSync. According to a complaint filed in Manhattan federal court, NumberSync uses the "same concept and architecture" with only "cosmetic changes," and its purported "inventors" were the same AT&T personnel who had worked with the plaintiffs.

• Carlyle Group Inc: Swiss-headquartered clinic chain Ameos is being prepared for a sale or refinancing as its private equity owner Carlyle seeks to cash out after almost a decade of ownership, people close to the matter said. Ameos runs 96 acute general care and psychiatric hospitals and has annual earnings of about 110 million euros before interest, tax, depreciation and amortization, the sources said. Several peers trade at about 12 times their core earnings. If sold at a similar multiple, Ameos could be valued at up to 1.3 billion euros, including debt, in a deal.

• Dr.Reddy's Laboratories Ltd: The Indian drugmaker said it had terminated its clinical study of Fujifilm Holdings' COVID-19 treatment Avigan in patients with moderate to severe symptoms in Kuwait. Data from the Kuwait trial, conducted in partnership with United Arab Emirates-based medical alliance Global Response Aid FZCO (GRA), showed that the difference in time taken by Avigan and placebo to resolve a sustained absence of oxygen in the tissues was not significant enough to continue the trial.

• Eli Lilly and Co & Regeneron Pharmaceuticals Inc: COVID-19 antibody drugs developed by Eli Lilly and Regeneron may be weaker against a new coronavirus variant found in South Africa, according to a study released on Tuesday based on laboratory tests. Scientists have said new variants found in South Africa and Britain seem highly transmissible, raising concern that current drugs and vaccines might be rendered less effective. The latest study comes as Eli Lily said on Tuesday it is moving a new antibody therapy to clinical trials targeting the South African variant. The study, which was done outside human bodies using a pseudovirus containing mutations found in the two variants to test antibody treatments, showed the South Africa variant appeared to affect a broader range of antibodies than the U.K. variant and was more worrisome.

• Falcon Capital Acquisition Corp: A blank-check acquisition firm backed by veteran investment banker Alan Mnuchin is in talks to merge with digital health startup Sharecare and take it public, people familiar with the matter said on Tuesday. Under the terms of the proposed deal, Sharecare would buy Palo Alto-based healthcare artificial intelligence startup Doc.ai and then merge with Mnuchin's special purposed acquisition company (SPAC) Falcon Capital Acquisition, the sources said. The deal with Falcon would value the combined entity at close to $4 billion, one of the sources added.

• GameStop Corp: Shares of the videogame retailer surged in pre-market trading as amateur investors continued to pile into the stock that has skyrocketed nearly 700% over the past two weeks. "These are not normal times and while the (Reddit) r/wallstreetbets thing is fascinating to watch, I can't help but think that this is unlikely to end well for someone," Deutsche Bank strategist Jim Reid said. Short sellers in GameStop are down $5 billion on a mark-to-market, net-of-financing basis in 2021, which included $876 million of losses early Tuesday, according to analytics firm S3 Partners.

• Goldman Sachs Group Inc: Chief Executive David Solomon's annual pay fell by $10 million, or 36%, in 2020, according to regulatory disclosures filed Tuesday, reflecting the bank's role in Malaysia's 1MDB scandal. Solomon will receive $17.5 million for his work during the year, compared with $27.5 million the year before, the bank said.

Goldman previously announced it would reduce Solomon's pay, along with that of Chief Financial Officer Stephen Scherr and Chief Operating Officer John Waldron, in light of the findings of investigations into the bank's role in the affair. Meanwhile, the investment bank lost its fight against an EU cartel fine handed down to its former Italian subsidiary and cable maker Prysmian after Europe's top court said it was liable for the actions of the unit.

• Nasdaq Inc: Nasdaq Clearing has been fined $36 million by Sweden's financial supervisory authority (FI) over the default of a power trader in 2018 that showed deficiencies in its operations, the FI said. The default by private Norwegian trader Einar Aas left a $139 million hole in the clearing house's resources, forcing other members of the market to cover the loss within two business days or face default themselves. Nasdaq Clearing, a Swedish unit of Nasdaq, had also violated EU regulations by investing its own funds in derivative contracts for too long after the default, the regulator said.

• Twitter Inc: The company has permanently suspended the account of My Pillow chief executive Mike Lindell for repeated violations of the company's policy on election misinformation, the social media firm said. Lindell, a devout supporter of former U.S. President Donald Trump, in a phone interview with Reuters on Tuesday pushed back at Twitter's reasons for the suspension, saying Twitter is "trying to destroy Mike Lindell - my reputation and my integrity." Lindell used his personal Twitter account, which had nearly half a million followers, and the My Pillow company's account to spread unsubstantiated claims of widespread voter fraud in the Nov. 3 election in which Democrat Joe Biden defeated Republican Trump. Lindell was suspended for repeatedly violating the company's civic integrity policy, Twitter said in a statement late on Monday. It is not clear which of Lindell’s tweets led to the ban.

• Vodafone Group Plc: British mobile networks Vodafone, O2 and Three are teaming up to build and share 222 mobile masts to boost 4G coverage in rural areas where there is only a patchy signal. The first stage of the shared rural network will increase coverage in each of the UK nations, with 124 new sites in Scotland, 33 in Wales, 11 in Northern Ireland and 54 in England, the companies said. Construction will start this year and is scheduled to be completed by 2024, they said.

• Walmart Inc: The company will add small robot-staffed warehouses to dozens of its stores to help fill orders for pickup and delivery, it said, as Americans shift their spending online amid the COVID-19 pandemic. The robots will work behind the scenes, picking frozen and refrigerated foods as well as smaller general merchandise items from inside the warehouses, or local fulfillment centers, that will carry "thousands of frequently purchased items." Store staff, meanwhile, will go to the sales floor to fetch fresh produce, meat, seafood and larger general merchandise items like large-screen TVs, then returning to the centers to finish assembling orders, the company said.

COLUMN

Bubble-wary markets eye ETF crush in tech and crypto: Mike Dolan

Is the presumed proliferation of market bubbles just speculative froth among amateur traders or is concentrated institutional money blowing big soapy spheres that interconnect and may inevitably burst each other?

ANALYSTS' RECOMMENDATION

• 3M Co: RBC raises target price to $197 from $193, after the company reported strong sequential improvements across all segments in fourth-quarter along with the rising demand of respirator masks.

• Amazon.com Inc: JP Morgan raises target price to $4,155 from $4,100, citing strong e-commerce & public cloud trends continuing rise.

• American Airlines Inc: Berenberg raises target price to $12 from $10, expecting a recovery in international travel as U.S. begins pre-arrival COVID-19 testing.

• Xerox Holdings Corp: Credit Suisse cuts rating to neutral from outperform, after the company delivered mixed fourth-quarter results.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Durable goods for Dec: Expected 0.9%; Prior 1.0%

0830 (approx.) Durables ex-transport for Dec: Expected 0.5%; Prior 0.4%

0830 (approx.) Durables ex-defense mm for Dec: Prior 0.8%

0830 (approx.) Nondefense cap ex-air for Dec: Expected 0.6%; Prior 0.5%

1400 Fed funds target rate: Expected 0-0.25%; Prior 0-0.25%

1400 (approx.) Fed int on excess reserves: Prior 0.10%

COMPANIES REPORTING RESULTS

Abbott Laboratories: Expected Q4 earnings of $1.35 per share

Ameriprise Financial Inc: Expected Q4 earnings of $4.52 per share

Amphenol Corp: Expected Q4 earnings of $1.02 per share

Apple Inc: Expected Q1 earnings of $1.41 per share

Boeing Co: Expected Q4 loss of $1.80 per share

Crown Castle International Corp: Expected Q4 earnings of 63 cents per share

Duke Realty Corp: Expected Q4 earnings of 15 cents per share

Edwards Lifesciences Corp: Expected Q4 earnings of 53 cents per share

Facebook Inc: Expected Q4 earnings of $3.22 per share

Hess Corp: Expected Q4 loss of 66 cents per share

Hologic Inc: Expected Q1 earnings of $2.17 per share

Lam Research Corp: Expected Q2 earnings of $5.72 per share

Las Vegas Sands Corp: Expected Q4 loss of 32 per share

Norfolk Southern Corp: Expected Q4 earnings of $2.48 per share

Packaging Corp of America: Expected Q4 earnings of $1.42 per share

Progressive Corp: Expected earnings of $1.66 per share

Raymond James Financial Inc: Expected Q1 earnings of $1.72 per share

Rollins Inc: Expected Q4 earnings of 13 cents per share

ServiceNow Inc: Expected Q4 earnings of $1.05 per share

SL Green Realty Corp: Expected Q4 loss of 22 cents per share

Stryker Corp: Expected Q4 earnings of $2.55 per share

TE Connectivity Ltd: Expected Q1 earnings of $1.28 per share

Teradyne Inc: Expected Q4 earnings of $1.01 per share

Tesla Inc: Expected Q4 earnings of $1.01 per share

United Rentals Inc: Expected Q4 earnings of $4.23 per share

Whirlpool Corp: Expected Q4 earnings of $6.07 per share

Xilinx Inc: Expected Q3 earnings of 68 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Nasdaq Inc: Q4 earnings conference call

0800 Textron Inc: Q4 earnings conference call

0830 Anthem Inc: Q4 earnings conference call

0830 AT&T Inc: Q4 earnings conference call

0830 Automatic Data Processing Inc: Q2 earnings conference call

0830 CH Robinson Worldwide Inc: Q4 earnings conference call

0830 Corning Inc: Q4 earnings conference call

0830 New York Community Bancorp Inc: Q4 earnings conference call

0830 VF Corp: Q3 earnings conference call

0845 Norfolk Southern Corp: Q4 earnings conference call

0900 Abbott Laboratories: Q4 earnings conference call

0900 Blackstone Group Inc: Q4 earnings conference call

0900 Encompass Health Corp: Q4 earnings conference call

0900 First Citizens BancShares Inc (Delaware): Q4 earnings conference call

0900 General Dynamics Corp: Q4 earnings conference call

0900 Oshkosh Corp: Q1 earnings conference call

1000 Boston Properties Inc: Q4 earnings conference call

1000 Hess Corp: Q4 earnings conference call

1000 Marketaxess Holdings Inc: Q4 earnings conference call

1000 Rollins Inc: Q4 earnings conference call

1000 Woodward Inc: Annual Shareholders Meeting

1030 Boeing Co: Q4 earnings conference call

1100 Teledyne Technologies Inc: Q4 earnings conference call

1130 Prosperity Bancshares Inc: Q4 earnings conference call

1300 Amphenol Corp: Q4 earnings conference call

1630 Aspen Technology Inc: Q2 earnings conference call

1630 Hologic Inc: Q1 earnings conference call

1630 Las Vegas Sands Corp: Q4 earnings conference call

1630 SEI Investments Co: Q4 earnings conference call

1630 Stryker Corp: Q4 earnings conference call

1700 Apple Inc: Q1 earnings conference call

1700 Cree Inc: Q2 earnings conference call

1700 Edwards Lifesciences Corp: Q4 earnings conference call

1700 Facebook Inc: Q4 earnings conference call

1700 Lam Research Corp: Q2 earnings conference call

1700 Levi Strauss & Co: Q4 earnings conference call

1700 PTC Inc: Q1 earnings conference call

1700 ServiceNow Inc: Q4 earnings conference call

1830 Tesla Inc: Q4 earnings conference call

EX-DIVIDENDS

American Campus Communities Inc: Amount $0.47

First Republic Bank: Amount $0.20

Dat GameStop is echt niet normaal meer, Elon Musk bemoeide zich er even mee en hop ... Was al even 290 dollar net. Waar gaat dat naartoe met deze meest gekke markt die ik ooit heb meegemaakt? Vergeet niet dat ze allemaal gaan omvallen he die newbies, ze speculeren zich kapot op die manier, eens komt er iets langs waar ze kapot aan gaan en alles verliezen !!

Wake-up call: Enorme divergentie tussen de grote 6 en de rest

Goedemorgen

De grote 6 en de rest, wat een verschil in waardeverloop vergeleken met de rest van de markt. Vandaag komt er weer een stroom aan bedrijfscijfers binnen met nabeurs in de VS (22:00) vooral 3 grote namen uit die TOP-6. Dat zijn Apple, Facebook en Tesla. Gisteren kwam Microsoft nabeurs al met recordcijfers die werden beloond met een koersstijging van 3,5%.

Aan de andere kant maken de cijfers van Texas Instruments weinig indruk hetgeen wat kan wegen op de chip sector vandaag waar we ook naar ASML kijken. Texas Instruments verloor nabeurs een goeie 2%.

Veel cijfers en de FED:

Deze week en dan vooral vandaag (woensdag 27 januari) veel cijfers en economisch nieuws want vanavond nabeurs komen zowel Apple, Facebook en Tesla met cijfers. Om 20:00 krijgen we de FED en om 20:30 zal Powell een persconferentie geven over het beleid van de FED. Komt er nog mee steun en dus QE de markt op? En wat denkt de FED over de economie enz...

Het rentebesluit zal naar verwachting niet echt voor verrassingen zorgen, maar de FED zal mogelijk communiceren dat men voorlopig een zeer verruimend monetair beleid blijft voeren. Zakenbank Goldman Sachs denkt dat de FED pas in 2022 begint met het terugschroeven van de obligatie-opkopen. Toch even afwachten wat er daar uit zal komen vanavond.

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.216 dollar, de prijs van een vat Brent olie komt uit op 56 dollar terwijl een troy ounce goud nu op 1848 dollar staat. De Bitcoin herpakt zich na enkele dolle dagen, nu moet je 31.750 dollar neertellen voor 1 Bitcoin ...

Inter Market overzicht vrijdag op slotbasis ...

Strategische posities opnemen:

Zodra u lid wordt ontvangt u de signalen en kunt u meteen de lopende posities inzien via onze Tradershop op de website. Ik probeer in ieder geval zo goed als dat kan om met de markt mee te gaan, wel is het zo dat de markt volatiel blijft en die volatiliteit kan zelfs nog wat gaan toenemen de komende periode.

Wat ik moet doen is in ieder geval blijven schakelen tussen long en short. Deze maand loopt wat wisselend, op zich met nog meer dan genoeg kansen uiteraard en we zitten nu nog met wat posities in de markt ... Doe nu mee met de nieuwe proef aanbieding die loopt tot 1 APRIL en dat met een mooie korting !!

Maak nu gebruik van de NIEUWE proef aanbieding:

Mis in ieder geval de start van 2021 niet want er komen hoe dan ook hele mooie kansen ... Via deze aanbieding ... €39 tot 1 APRIL 2021 ... Polleke €49 tot 1 APRIL 2021 !!!

Systeem Trading (€39 tot 1 APRIL)

Index Trading (€39 tot 1 APRIL)

Polleke Trading (€49 tot 1 APRIL)

Aandelen portefeuille (€30 tot 1 APRIL)

COMBI TRADING (€79 tot 1 APRIL)

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

The International Monetary Fund on Tuesday raised its forecast for global economic growth in 2021 and said the coronavirus-triggered downturn last year - the biggest peacetime contraction since the Great Depression - would be nearly a full percentage point less severe than expected.

Global coronavirus cases surpassed 100 million, according to a Reuters tally, as countries around the world struggle with new virus variants and vaccine shortfalls.

Europe urged pharmaceutical companies on Tuesday to honour their commitments to supply coronavirus vaccines, as delivery cuts and delays dim hopes of a quick fix to COVID-19 and increase talk of protectionism and hoarding.

EUROPEAN COMPANY NEWS

UniCredit is set to name Andrea Orcel as chief executive, a person familiar with the matter said on Tuesday, putting one of Europe's best-known dealmakers at the helm just as the coronavirus crisis is pushing banks to merge.

AstraZeneca has offered to bring forward some deliveries of its COVID-19 vaccine to the European Union while the bloc has asked the British drugmaker if it can divert doses from the UK to make up for a shortfall in supplies, European officials told Reuters.

Booming sales at LVMH's fashion brands like Louis Vuitton, particularly in China, helped to cushion the impact of the coronavirus pandemic, which has crimped revenues at the French luxury group.

TODAY'S COMPANY ANNOUNCEMENTS

AJ Bell PLC Annual Shareholders Meeting

Ambu A/S Q1 2021 Earnings Call

Core Laboratories NV Q4 2020 Earnings Release

Critical Metals PLC Annual Shareholders Meeting

Essity AB (publ) FY 2020 Earnings Call

Koninklijke KPN NV Q4 2020 Earnings Release

Lonza Group AG FY 2020 Earnings Call

Marston's PLC Annual Shareholders Meeting

Rias A/S Q1 2021 Earnings Release

Sartorius AG Q4 2020 Earnings Release

Sesa SpA Shareholders Meeting

Skandinaviska Enskilda Banken AB Q4 2020 Earnings Release

Software AG FY 2020 Earnings Release

TE Connectivity Ltd Q1 2021 Earnings Release

ECONOMIC EVENTS (All times GMT)

0700 Germany GfK Consumer Sentiment for Feb: Expected -7.9; Prior -7.3

0700 (approx.) Sweden Money Market CPIF Inflation 1-Year for Jan: Prior 1.0%

0700 (approx.) Sweden Money Market CPIF Inflation 5-Years for Jan: Prior 1.7%

0745 France Consumer Confidence for Jan: Expected 94; Prior 95

0830 Sweden Trade Balance for Dec: Prior 1.4 bln SEK

0830 Sweden Exports for Dec: Prior 128.0 bln SEK

0830 Sweden Imports for Dec: Prior 126.6 bln SEK

0900 (approx.) Italy Flash Trade Balance Non-EU for Dec: Prior 6.68 bln EUR

0900 Switzerland Investor Sentiment for Jan: Prior 46.8

0900 Austria Purchasing Managers Index for Jan: Prior 53.5

1100 (approx.) France Unemployment Class-A SA for Dec: Prior 3,586,300

DEBT AUCTIONSGermany - Reopening of 10-year government debt auction.Italy - Reopening of 6-month government debt auction.Sweden - Reopening of 3-year and 10-year government debt auctions.United Kingdom - Reopening of 11-year government debt auction