Liveblog Archief donderdag 28 januari 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Nieuwe Woningen Verkoop (Dec) | Actueel: 842K Verwacht: 865K Vorige: 829K |

TA AEX, ASML, IMCD, Arcelor en ASM International

Donderdag gehaktdag oftewel vijf grafieken voor de prijs van vier! We gaan langs de grafieken van de AEX, ASML, ASM international, IMCD en Arcelor Mittal wandelen. Wat is de technische conditie van de grafieken na een stapje terug? Ik ga snel aan de slag.Arcelor Mittal bijt het spits af. De…

Lees verder »Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: BBP (Kwartaal) (Q4) | Actueel: 4,0% Verwacht: 4,0% Vorige: 33,4% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 847K Verwacht: 875K Vorige: 914K |

Markt snapshot Wall Street vandaag

TOP NEWS

U.S. economy likely logged its weakest performance in 74 years in 2020

The U.S. economy likely contracted at its sharpest pace since World War Two in 2020 as COVID-19 ravaged services businesses like restaurants and airlines, throwing millions of Americans out of work and into poverty.

• Southwest Airlines posts first annual loss since 1972 on virus woes

Southwest Airlines reported an annual loss of $3.1 billion, its first since 1972, and said it was facing stalled demand in January and February driven by high levels of COVID-19 cases and hospitalizations.

• Dow quarterly results beat on higher demand, prices

Dow reported quarterly results that beat analysts' estimates, helped by higher prices and demand for its chemicals following a recovery from the impact of the COVID-19 pandemic.

• Regulators press Deutsche Bank CEO to drop investment bank role - sources

Regulators are pressing Deutsche Bank CEO Christian Sewing to relinquish day-to-day oversight of its sprawling investment bank, two people with knowledge of the matter said.

Racing the virus: Why tweaking the vaccines won't be simple

After developing and rolling out COVID-19 vaccines at record speed, drugmakers are already facing variants of the rapidly-evolving coronavirus that may render them ineffective, a challenge that will require months of research and a massive financial investment, according to disease experts.

BEFORE THE BELL

The S&P 500 and Nasdaq futures slipped, while Dow futures were little changed, as investors locked in gains in heavyweights Apple and Facebook following their upbeat earnings, while also awaiting a reading on fourth-quarter GDP and weekly jobless claims data. European stockswere in the red and Japan’s Nikkei ended lower following Wall Street's worst sell-off since October in the previous session on concerns about high valuations. Gold prices slid as investors opted for the relative shelter of the dollar from souring risk sentiment and after the Fed expressed worries over the slow pace of economic recovery. Oil declined fuelled by fresh travel curbs to prevent new coronavirus outbreaks and delays to vaccine rollouts. New home sales, wholesale inventories and personal consumption expenditure numbers are also due later in the day on the U.S. economic calendar. Visa is expected to report results after market’s close.

STOCKS TO WATCH

Results

• Apple Inc: The company on Wednesday reported holiday quarter sales and profits that beat Wall Street expectations, as new 5G iPhones helped push handset revenue to a new record and sparked a 57% rise in China sales. Apple's revenue for the quarter ended rose 21% to $111.44 billion. Earnings per share rose to $1.68 from $1.25, beating Wall Street targets. Sales of iPhones were $65.60 billion and beat a record set three years ago. China proved a strong market for iPhone, with overall sales there rising 57% to $21.31 billion. Meanwhile, Apple's smartphone shipments jumped 22% to record levels in the fourth quarter, making it the world's biggest seller, while those for Huawei plunged as U.S. sanctions took effect.

• Diageo Plc: The company reported an unexpected rise in underlying net sales growth for the first half of its year on strong demand for spirits like tequila at retail stores in the United States. North America sales rose 12% in the six months, driven by strong consumer demand and a continuing shift towards spirits over beer and wine. Retailers also replenished more stock ahead of the holiday season. Overall, Diageo reported a 1% rise in organic net sales growth, compared with expectations for a 4.6% drop, according to company supplied estimates. Adjusted earnings fell nearly 13% to 69.9 pence per share, but beat the 67.8 pence analysts had expected, hit by higher operating costs and a stronger pound. Diageo also raised its interim dividend by 2% to 27.96 pence per share.

• Dow Inc: The company reported quarterly results that beat analysts' estimates, helped by higher prices and demand for its chemicals following a recovery from the impact of the COVID-19 pandemic. The company's Chief Executive Officer Jim Fitterling said he expects margins to improve as different parts of Dow's portfolio see improving demand. Net operating income, which excludes some items, rose to $607 million, or 81 cents per share, in the three months ended Dec. 31, from $376 million, or 50 cents per share, in the third quarter. Dow also reported sales of $10.71 billion, compared with estimates of $10.03 billion.

• Facebook Inc: The company soundly beat quarterly revenue estimates on Wednesday after heavy holiday advertising by e-commerce retailers, but it warned Apple's impending privacy changes could hurt revenue by interfering with ad targeting. The social media company said it expected to face "significant ad targeting headwinds in 2021." Facebook forecast that Apple's update of its iPhone operating system to iOS 14 could start biting into revenues as early as the end of the first quarter. Monthly active users rose 12% to 2.80 billion, above the 2.75 billion expected by analysts. Total revenue, which consists almost entirely of advertising sales, rose 33% to $28.07 billion in the fourth quarter from $21.08 billion a year earlier. Analysts said Facebook is less likely to suffer from Apple's privacy updates than other ad-supported companies that have less access to their own first-party data.

• Southwest Airlines Co: The company reported an annual loss of $3.1 billion, its first since 1972, and said it was facing stalled demand in January and February driven by high levels of COVID-19 cases and hospitalizations. The airline forecast first-quarter average core cash burn of about $17 million per day, higher than the $12 million per day it recorded in the fourth quarter. The company reported a net loss of $908 million, or $1.54 per share, in the fourth quarter, compared with a profit of $514 million, or 98 cents per share, a year earlier. On an adjusted basis, the company lost $1.29 per share. Total operating revenue plunged 64.9% to $2.01 billion.

• Tesla Inc: The company's fourth-quarter profit fell short of Wall Street expectations on Wednesday and the company failed to provide a clear target for 2021 vehicle deliveries. At $10.74 billion, Tesla quarterly revenue slightly surpassed analyst expectations of $10.4 billion. Tesla delivered 180,570 vehicles during the fourth quarter, a quarterly record, even though it narrowly missed its ambitious 2020 goal of half a million deliveries. Tesla has also begun building vehicle and battery manufacturing factories near Berlin, Germany, and Austin, Texas, and on Wednesday said it remained on track to start deliveries from each location this year. The average sales price per vehicle dipped 11% on a yearly basis, with more consumers switching to the less expensive Model 3 and Model Y.

• Valero Energy Corp: The U.S. refiner's losses narrowed for the three months to December from the previous quarter, as fuel demand slightly recovered on easing COVID-19 restrictions in some parts of the world. "We expect to see continued improvement in product demand with widespread vaccine distribution around the world," Chief Executive Officer Joe Gorder said in a statement. Adjusted net loss attributable to Valero stockholders narrowed to $429 million, or $1.06 per share, in the three months ended Dec. 31, from $472 million, or $1.16 per share, in the third quarter.

Moves

• Rio Tinto Plc: The company named a new head of its iron ore division as part of a leadership reshuffle as it works to rebuild partnerships with Indigenous groups after the global miner destroyed ancient, sacred caves in Australia. Chief Commercial Officer Simon Trott will head the Australian iron ore business, the company said, moving back to Western Australia from Singapore where he ran the company's marketing division. Arnaud Soirat, head of Rio's copper & diamonds business, was appointed to the newly created role of chief operating officer for a fixed 18-month term before he retires.

In Other News

• Alphabet Inc: An Australian regulator is considering letting internet users choose what personal data companies like Google share with advertisers, as part of the country's attempts to shatter the dominance of tech titans. The Australian Competition and Consumer Commission (ACCC) also proposed limiting the internet giants' ability to access users' online histories to cross-sell products. The proposals were part of the ACCC's interim report into digital advertising in Australia, a $2.6 billion market the regulator said is marked by a lack of competition, transparency and choice. The ACCC estimates Google's share of Australian digital advertising revenue at between 50% and 100%, depending on the service.

• AstraZeneca PLC: South Korea will review the use of AstraZeneca's COVID-19 vaccine for the elderly because of limited efficacy data, the government said, as it unveiled a plan to inoculate 10 million high-risk people by July. "There is an insufficient number of test cases of elderly people in the clinical test data that have been submitted so we need a statistical review," Ministry of Food and Drug Safety official Kim Sang-bong told the briefing. The review will include a study of immune response data used in the vaccine's European approval, he said.

• Boeing Co: The company has received a licence from the U.S. government to offer its F-15EX fighter jet to the Indian air force, a senior executive said. Boeing will compete with Sweden's Gripen and France's Rafale among others for the Indian air force's plan to buy 114 multi-role aircraft to replace its Soviet-era fleet. Ankur Kanaglekar, director, India Fighters Lead, Boeing Defense, Space & Security, told reporters discussions on the F-15EX had taken place earlier between the two governments.

"Now that we have the marketing licence it allows us to talk to the Indian Air Force directly about the capability of the fighter. We have started doing that in a small way," he said, adding conversations were expected to gather pace during the Aero India show next week.

• CureVac NV: The German biotech firm set the price of its secondary offering at $90 for each of the 5 million shares it is placing, the company said, as it starts late-stage trials of a COVID-19 vaccine candidate. The offering, which should close on Feb. 1, 2021, includes a 30-day option to buy up to 750,000 additional shares at the price of the offering, the company said.

• Deutsche Bank AG: Regulators are pressing Deutsche Bank CEO Christian Sewing to relinquish day-to-day oversight of its sprawling investment bank, two people with knowledge of the matter said. European Central Bank officials have held conversations with Deutsche Bank managers, including Sewing, in which they said the CEO should delegate direct control of the division to another board member, according to the sources, who were involved in or briefed on the discussions. It was unclear when regulators last voiced their concerns directly, but the two people said over the past week that the bank was well aware of their position, with one adding that contact with Deutsche was "constant". They said regulators fear Sewing has too much on his plate, leaving the investment bank open to operational hazards. While they want Sewing to hand over day-to-say oversight to another manager, he would retain ultimate responsibility as group CEO under their proposals, the sources said.

• GameStop Corp: India's small investors are snapping up shares of U.S. retail investor favourite GameStop, making the video game retailer the most traded stock on some Indian brokerages after anonymous social media posts fuelled a frenzied rally. Shares of GameStop have surged 1,700% since Jan. 12 as amateur U.S. investors, monitoring social media comments, have piled in and forced professional short-sellers to abandon their positions with heavy losses.

• Facebook Inc: UK's competition watchdog launched its initial investigation into Facebook's completed acquisition of GIF website Giphy, at a time when the social media network is under global regulatory scrutiny over antitrust concerns. "We will continue to fully cooperate with the CMA's investigation. This merger is procompetitive and in the interests of everyone in the UK who uses GIPHY and our services," a Facebook spokesperson said. The CMA said it has until March 25 to decide whether it should make a reference for an in-depth investigation.

• FedEx Corp: The freight carrier will temporarily relocate its Hong Kong-based pilots to San Francisco because it expects the Asian financial capital to establish strict 14-day hotel quarantine requirements for crew, it said in a memo to pilots. The company said it did not think it was appropriate to subject Hong Kong-based crew members to extended periods of isolation, preventing them from seeing their families after finishing a trip.

• Pfizer Inc & BioNTech SE: The companies’ COVID-19 vaccine appeared to lose only a small bit of effectiveness against an engineered virus with three key mutations from the new coronavirus variant found in South Africa, according to a laboratory study conducted by the U.S. drugmaker. The study by Pfizer and scientists from the University of Texas Medical Branch, which has not yet been peer-reviewed, showed a less than two-fold reduction in antibody titer levels, indicating the vaccine would likely be effective in neutralizing a virus with the so-called E484K and N501Y mutations found in the South African variant. Meanwhile, Pfizer will continue to supply its COVID-19 vaccine to Italy, respecting its agreement with the European Commission, even if Rome sues the company, the chief executive of the group's Italian unit said.

• Property Solutions Acquisition Corp: Electric-vehicle maker Faraday Future has agreed to go public through a merger with blank-check firm Property Solutions Acquisition in a deal valuing the combined entity at $3.4 billion, the latest firm to take the SPAC route to enter public markets. Faraday and Property Solutions said the deal, supported by a private investment of $775 million, is expected to fetch Faraday Future $1 billion in gross proceeds. The combined company will be listed on Nasdaq under the ticker symbol "FFIE", the companies said.

• Taiwan Semiconductor Manufacturing Co Ltd: The company is "expediting" auto-related products through its wafer fabs and reallocating wafer capacity, the company said, amid a global shortage of auto chips. In a statement, TSMC said it was addressing the chip supply "challenges" as their top priority. "The automotive supply chain is long and complex and we have worked with our automotive customers and identified their critical needs," the world's largest contract chipmaker said.

• Toyota Motor Corp: The company overtook Germany's Volkswagen in vehicle sales last year, regaining pole position as the world's top selling automaker for the first time in five years as the pandemic demand slump hit its German rival harder. Toyota said its group-wide global sales fell 11.3% to 9.528 million vehicles in 2020. That compared with a 15.2 percent drop at Volkswagen to 9.305 million vehicles.

• Qualcomm Inc: The company lost its fight against a data demand from EU antitrust regulators after Europe's top court reaffirmed the regulators' right to see it, in a case that has already landed the company a $292.60 million fine. The ruling by the Luxembourg-based Court of Justice of the European Union (CJEU) will strengthen the European Commission's hand in other antitrust investigations. Qualcomm's run-ins with the Commission have seen it receive total fines of 1.2 billion euros in two cases in the last three years for using its market power to thwart rivals including Intel.

ANALYSIS

Short sellers face derision, death threats and unexplained pizza

Making money by betting a company's shares will sink in value has become more challenging in recent weeks as markets rocketed higher and a growing wave of investors became ready to take on short sellers at almost any cost - even threatening their lives.

ANALYSTS' RECOMMENDATION

• Anthem Inc: Credit Suisse cuts target price to $382 from $389, following a lower-than-expected 2021 EPS guidance.

• Autoliv Inc: Jefferies raises target price to $110 from $103, after the company delivered a strong fourth-quarter.

• Bed Bath & Beyond Inc: Baird cuts rating to neutral from outperform, following the stock's robust year-to-date performance.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for Dec: Prior 1.709 mln

0800 (approx.) Building permits R change mm for Dec: Prior 4.5%

0830 (approx.) GDP advance for Q4: Expected 4.0%; Prior 33.4%

0830 (approx.) GDP sales advance for Q4: Prior 25.9%

0830 (approx.) GDP cons spending advance for Q4: Prior 41.0%

0830 (approx.) GDP deflator advance for Q4: Expected 2.4%; Prior 3.7%

0830 (approx.) Core PCE prices advance for Q4: Expected 1.5%; Prior 3.4%

0830 (approx.) PCE prices advance for Q4: Prior 3.7%

0830 (approx.) Advance goods trade balance for Dec: Prior -$85.49 bln

0830 (approx.) Wholesale inventories advance for Dec: Prior 0.0%

0830 (approx.) Retail inventories ex-auto advance for Dec: Prior 0.2%

0830 Initial jobless claims: Expected 875,000; Prior 900,000

0830 Jobless claim 4-week average: Prior 848,000

0830 Continued jobless claims: Expected 5.054 mln; Prior 5.054 mln

1000 (approx.) Leading index change mm for Dec: Expected 0.3%; Prior 0.6%

1000 (approx.) New home sales-units for Dec: Expected 0.865 mln; Prior 0.841 mln

1000 (approx.) New home sales change mm for Dec: Expected 1.9%; Prior -11.0%

1100 (approx.) KC Fed Manufacturing for Jan: Prior 12

1100 (approx.) KC Fed Composite Index for Jan: Prior 14

COMPANIES REPORTING RESULTS

Arthur J Gallagher & Co: Expected Q4 earnings of 78 cents per share

Celanese Corp: Expected Q4 earnings of $1.71 per share

Eastman Chemical Co: Expected Q4 earnings of $1.50 per share

Juniper Networks Inc: Expected Q4 earnings of 53 cents per share

Marsh & McLennan Companies Inc: Expected Q4 earnings of $1.12 per share

Mastercard Inc: Expected Q4 earnings of $1.51 per share

Mondelez International Inc: Expected Q4 earnings of 66 cents per share

Nucor Corp: Expected Q4 earnings of $1.18 per share

Principal Financial Group Inc: Expected Q4 earnings of $1.42 per share

Resmed Inc: Expected Q2 earnings of $1.26 per share

Robert Half International Inc: Expected Q4 earnings of 68 cents per share

Skyworks Solutions Inc: Expected Q1 earnings of $2.08 per share

Tractor Supply Co: Expected Q4 earnings of $1.51 per share

Visa Inc: Expected Q1 earnings of $1.28 per share

Western Digital Corp: Expected Q2 earnings of 54 cents per share

Xcel Energy Inc: Expected Q4 earnings of 54 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 ABIOMED Inc: Q3 earnings conference call

0800 Danaher Corp: Q4 earnings conference call

0800 Dow Inc: Q4 earnings conference call

0800 Landstar System Inc: Q4 earnings conference call

0800 McCormick & Company Inc: Q4 earnings conference call

0800 SLM Corp: Q4 earnings conference call

0800 Stanley Black & Decker Inc: Q4 earnings conference call

0800 Whirlpool Corp: Q4 earnings conference call

0815 Raymond James Financial Inc: Q1 earnings conference call

0830 American Airlines Group Inc: Q4 earnings conference call

0830 CACI International Inc: Q2 earnings conference call

0830 Comcast Corp: Q4 earnings conference call

0830 Eagle Materials Inc: Q3 earnings conference call

0830 Marsh & McLennan Companies Inc: Q4 earnings conference call0830 Mcdonald's Corp: Q4 earnings conference call

0830 MKS Instruments Inc: Q4 earnings conference call

0830 Pultegroup Inc: Q4 earnings conference call

0830 Teradyne Inc: Q4 earnings conference call

0830 Westrock Co: Q1 earnings conference call

0900 Altria Group Inc: Q4 earnings conference call

0900 Ameriprise Financial Inc: Q4 earnings conference call

0900 Mastercard Inc: Q4 earnings conference call

0900 Northrop Grumman Corp: Q4 earnings conference call

0900 Valvoline Inc: Annual Shareholders Meeting

0900 Walgreens Boots Alliance Inc: Annual Shareholders Meeting

0930 Packaging Corp of America: Q4 earnings conference call

1000 A. O. Smith Corp: Q4 earnings conference call

1000 Dover Corp: Q4 earnings conference call

1000 JetBlue Airways Corp: Q4 earnings conference call

1000 Post Holdings Inc: Annual Shareholders Meeting

1000 South State Corp: Q4 earnings conference call

1000 Tractor Supply Co: Q4 earnings conference call

1000 Valero Energy Corp: Q4 earnings conference call

1000 Xcel Energy Inc: Q4 earnings conference call

1030 Ashland Global Holdings Inc: Annual Shareholders Meeting

1030 Crown Castle International Corp: Q4 earnings conference call

1100 Brunswick Corp: Q4 earnings conference call

1100 MSCI Inc: Q4 earnings conference call

1100 Sherwin-Williams Co: Q4 earnings conference call

1100 Tetra Tech Inc: Q1 earnings conference call

1100 United Rentals Inc: Q4 earnings conference call

1130 East West Bancorp Inc: Q4 earnings conference call

1230 Southwest Airlines Co: Q4 earnings conference call

1400 Air Products and Chemicals Inc: Annual Shareholders Meeting

1400 Cullen/Frost Bankers Inc: Q4 earnings conference call

1400 Nucor Corp: Q4 earnings conference call

1400 SL Green Realty Corp: Q4 earnings conference call

1500 Duke Realty Corp: Q4 earnings conference call

1500 Old Republic International Corp: Q4 earnings conference call

1630 Resmed Inc: Q2 earnings conference call

1630 Skyworks Solutions Inc: Q1 earnings conference call

1630 Western Digital Corp: Q2 earnings conference call

1700 Dolby Laboratories Inc: Q1 earnings conference call

1700 Fair Isaac Corp: Q1 earnings conference call

1700 Houlihan Lokey Inc: Q3 earnings conference call

1700 Juniper Networks Inc: Q4 earnings conference call

1700 MicroStrategy Inc: Q4 earnings conference call

1700 Mondelez International Inc: Q4 earnings conference call

1700 National Instruments Corp: Q4 earnings conference call

1700 Robert Half International Inc: Q4 earnings conference call

1700 Visa Inc: Q1 earnings conference call

1715 Arthur J Gallagher & Co: Q4 earnings conference call

EX-DIVIDENDS

A. O. Smith Corp: Amount $0.26

AES Corp: Amount $0.15

Alliant Energy Corp: Amount $0.40

Conagra Brands Inc: Amount $0.27

Eaton Vance Corp: Amount $0.37

Lennar Corp: Amount $0.25

Morgan Stanley: Amount $0.35

National Retail Properties Inc: Amount $0.52

Pfizer Inc: Amount $0.39

SL Green Realty Corp: Amount $0.30

Unum Group: Amount $0.28

Vandaag maar eens zien waar het circus van de BIG-3 ons naartoe zal leiden ... Cijfers Apple en Facebook waren goed, die van Tesla kan ik niet beoordelen want het aandeel laat zich niet shorten en wil alleen maar omhoog. En sinds kort weten we hoe dat werkt ... Anders zorgt Elon Musk daar wel voor ...

Wake-up call: Grote daling Wall Street, hebzucht en speculatie gehalte houden aan

Goedemorgen

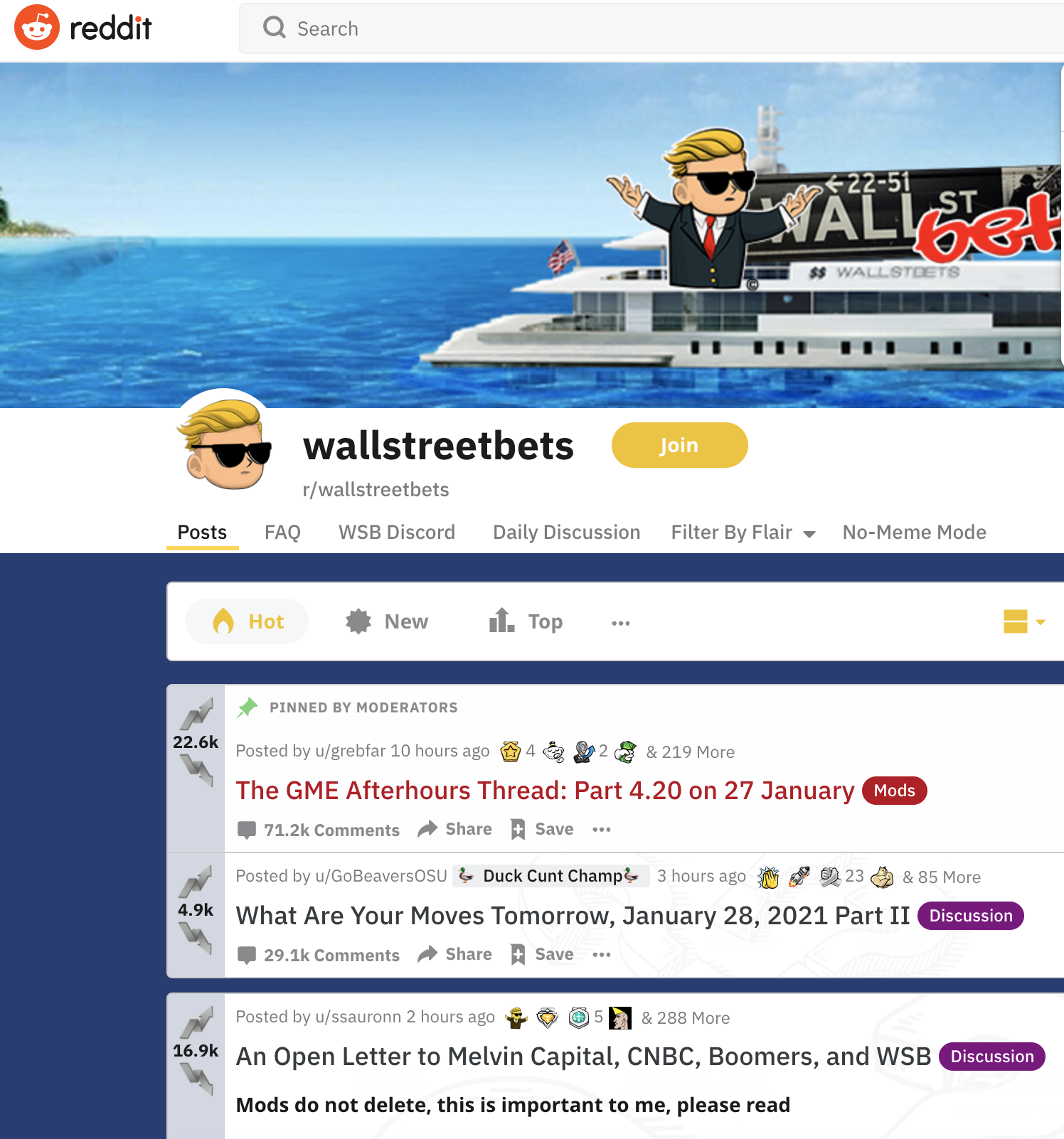

De haaien en de vissen is waar het nu om gaat op Wall Street, via het bekende Wallstreetbets platform Reddit lokt een grote groep met kleine speculanten de grote Hedgefunds uit door aandelen die short voor hun interessant zijn massaal de hoogte in te sturen tot ongekende hoogtes.

Deze maand hebben we dat gezien bij onder andere GameStop dat woensdag maar liefst 135% hoger de sessie afsloot maar ook een bioscoop bedrijfje genaamd AMC kreeg men gisteren maar liefst 301% hoger. Deze gang van zaken doet me teruggaan naar 1999-2000 waar je toen in mindere mate dan hoe het nu is maar ook zeker een zelfde soort hype had met grote tradingrooms via de IRC chat en de nieuwsgroepen bij outlook. Ook toen dreef men bepaalde aandelen naar ongekende hoogtes toen succestraders ze aanprijzen aan de kleinere speculanten die mee willen doen met OTM opties. (kopie gedrag)...

Er zullen zeker nog wel lezers zijn die zich dat nog herinneren al vrees ik dat de nieuwe groep beleggers-speculanten niet weten waar ik het over heb en hoe het toen allemaal afliep. GameStop en AMC herinneren mij daarom aan eerdere tijden waar er zoiets gaande was en gelukkig weet ik ook wel hoe dit afliep toen. Het zal ook nu met een knal aflopen want zoals ik al aangaf, het gaat allemaal te gemakkelijk en er zijn heel wat grote partijen die ze hebben uitgedaagd en nu behoorlijk Pissed off zijn door deze gang van zaken en 1 ding weet ik zeker, ze gaan zich op een bepaald moment enorm revangeren richting deze groepen.

Uiteraard is er niks nieuws aan een short squeeze, daar heb ik het al vaak genoeg over gehad maar meestal gaat het juist andersom, het zijn de professionele beleggers die de shorters proberen uit de markt te krijgen om zo grotere verliezen te voorkomen en daarom moeten ze zich daarvoor indekken. Het is marktwerking, andersom doet men dat ook, soms dwingen grote partijen beleggers om aandelen te verkopen om zo grotere verliezen te voorkomen. Meestal is het een dubbele werking, een aandeel of index gaat omhoog en dat lokt kopers en het dwingt shorters om verlies te nemen, om eruit te stappen. Aan de verkoopkant hetzelfde, zakt de markt fors door dan dwingt het om beleggers het verlies te nemen en gaan grote partijen short om zo te kunnen verdienen aan een daling.

Het probleem zit niet in de marktwerking, wel in wie dat doet en zoals nu zitten de grote funds met een enorme groep met kleine spelers die enkele grote spelers willen volgen via een enorm FORUM dat elke dag nog groter wordt. Let wel, het ruikt naar manipulatie, we weten allemaal dat slechts de eersten zullen profiteren van dit soort gedrag, de rest loopt er achteraan en is te laat en zal veel verliezen. Maar de succesverhalen zullen andere aanzetten om ook mee te doen. Het is een tijdelijk verhaal, normaal gezien is dat zo, ik ben zeer benieuwd hoe dat zal aflopen. Er zullen in ieder geval een aantal grote winnaars uit voorkomen, anderen zullen dus met niks achterblijven en wie weet ook met grote schulden ... Er zijn nu al vele miljoenen volgers, deelnemers in deze rooms aanwezig, het zal nog wel een tijdje het nieuws van de dag blijven ...

Wat betreft short selling is er 1 groot gevaar, wel te overwegen waard uiteraard maar het is een groot gevaar. De dalingen blijven beperkt tot 0 maar de weg omhoog is oneindig. Wat ik wil zeggen is dat als je een aandeel short verkoopt en het kost $20 dan kan men maximaal tot $0 terug en win je $20 op je short (maximaal). Maar als het niet goed gaat kan dat aandeel van $20 naar pakweg $1000-$2000-$3000 en veel hoger, dat is wat je nu ziet met dat GameStop en AMC, men kan iets wat NIKS is opdrijven naar niveau's die ongekend zijn. Wat deze keer zo uniek is, is de manier waarop die kleintjes zich via Reddit en andere forums hebben verenigd om de strijd aan te gaan met die grote partijen short sellers.

Goed, genoeg hierover, even zien hoe het verder zal verlopen. Gisteren een slechte dag op Wall Street met verliezen tussen de 2 en 3%. Ook Europa verloor gisteren, de AEX 10,6 punten de DAX verloor 250 punten. Zelf was ik een beetje te voorzichtig deze week, met de cijfers van Apple, Facebook en Tesla nabeurs en de FED die ook nog kwam na het slot hier in Europa speelde ik op safe. En als je dan nog die verhalen leest over het uitroken van de short spelers wordt je vanzelf al wat voorzichtiger met shorts. Aan het begin van de sessie zag het er nog niet uit dat we de dieperik zouden ingaan na de middag. Dus ik was wat voorzichtig met al deze feiten, ook de moeilijke markt blijft aanhouden maar er komen wel kansen, daar ben ik van overtuigd, mogelijk in de loop van de dag al voor de leden ...

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.208 dollar, de prijs van een vat Brent olie komt uit op 55,1 dollar terwijl een troy ounce goud nu op 1833 dollar staat. De Bitcoin herpakt zich na enkele dolle dagen, nu moet je 31.250 dollar neertellen voor 1 Bitcoin ...

Inter Market overzicht vrijdag op slotbasis ...

Strategische posities opnemen:

Zodra u lid wordt ontvangt u de signalen en kunt u meteen de lopende posities inzien via onze Tradershop op de website. Ik probeer in ieder geval zo goed als dat kan om met de markt mee te gaan, wel is het zo dat de markt volatiel blijft en die volatiliteit kan zelfs nog wat gaan toenemen de komende periode.

Wat ik moet doen is in ieder geval blijven schakelen tussen long en short. Deze maand loopt wat wisselend, op zich met nog meer dan genoeg kansen uiteraard en we zitten nu nog met wat posities in de markt ... Doe nu mee met de nieuwe proef aanbieding die loopt tot 1 APRIL en dat met een mooie korting !!

Maak nu gebruik van de NIEUWE proef aanbieding:

Mis in ieder geval de start van 2021 niet want er komen hoe dan ook hele mooie kansen ... Via deze aanbieding ... €39 tot 1 APRIL 2021 ... Polleke €49 tot 1 APRIL 2021 !!!

Systeem Trading (€39 tot 1 APRIL)

Index Trading (€39 tot 1 APRIL)

Polleke Trading (€49 tot 1 APRIL)

Aandelen portefeuille (€30 tot 1 APRIL)

COMBI TRADING (€79 tot 1 APRIL)

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

The Federal Reserve left its key overnight interest rate near zero and made no change to its monthly bond purchases, pledging again to keep those economic pillars in place until there is a full rebound from the pandemic-triggered recession.

Prime Minister Boris Johnson indicated the COVID-19 lockdown in England would last until March 8 when schools could start to reopen as the government announced new measures to clamp down on travel to and from Britain.

Apple cornered nearly a quarter of the global smartphone market in the fourth quarter, making it the world's biggest seller, while shipments for Huawei plunged as U.S sanctions against it took effect.

EUROPEAN COMPANY NEWS

The European Union failed to make a breakthrough in crisis talks with AstraZeneca and demanded the drugmaker spell out how it would supply the bloc with reserved doses of COVID-19 vaccine from plants in Europe and Britain.

Fiat Chrysler said it will plead guilty to charges it conspired with company executives to make illegal, lavish gifts to United Auto Workers leaders and undermined workers' confidence in collective bargaining.

Rio Tinto named a new head of its iron ore division as part of a leadership reshuffle as it works to rebuild partnerships with Indigenous groups after the global miner destroyed ancient, sacred caves in Australia.

TODAY'S COMPANY ANNOUNCEMENTS

2020 Bulkers Ltd Q4 2020 Earnings Release

Atlassian Corporation PLC Q2 2021 Earnings Release

Britvic PLC Annual Shareholders Meeting

Cardtronics PLC Q4 2020 Earnings Release

Concordia Maritime AB FY 2020 Earnings Call

Core Laboratories NV Q4 2020 Earnings Call

Enwell Energy PLC Shareholders Meeting

Equatorial Palm Oil PLC Annual Shareholders Meeting

Granges AB Q4 2020 Earnings Release

Henderson European Focus Trust PLC Annual Shareholders Meeting

Kaufman & Broad SA Q4 2020 Earnings Release

Kone Oyj Q4 2020 Earnings Release

Lundin Energy AB Q4 2020 Earnings Call and Capital Markets Day

Navigator Company SA FY 2020 Earnings Call

NAXS AB (publ) Q4 2020 Earnings Release

Nexam Chemical Holding AB Q4 2020 Earnings Release

Orexo AB Q4 2020 Earnings Call

OSB Group PLC Shareholders Meeting

Pareto Bank ASA Q4 2020 Earnings Call

Pentair PLC Q4 2020 Earnings Call

RDI Reit PLC Annual Shareholders Meeting

Renew Holdings PLC Annual Shareholders Meeting

Roblon A/S Annual Shareholders Meeting

SGS SA FY 2020 Earnings Call

Sligro Food Group NV FY 2020 Earnings Call

Stolt-Nielsen Ltd Q4 2020 Earnings Call

Sunrise Resources Plc Annual Shareholders Meeting

Tertiary Minerals PLC Annual Shareholders Meeting

TF Bank AB Q4 2020 Earnings Release

UPM-Kymmene Oyj Q4 2020 Earnings Call

VNV Global AB (publ) Q4 2020 Earnings Call

Xvivo Perfusion AB FY 2020 Earnings Call

ECONOMIC EVENTS (All times GMT)

0530 Netherlands Manufacturing Confidence for Jan: Prior -0.4

0700 Switzerland Trade for Dec: Prior 4,458 mln

0800 (approx.) Germany BB State CPI MM for Jan: Prior 0.7%

0800 (approx.) Germany BB State CPI YY for Jan: Prior -0.1%

0800 Germany SN State CPI MM for Jan: Prior 0.5%

0800 Germany SN State CPI YY for Jan: Prior 0.0%

0800 Spain Unemployment Rate for Q4: Expected 16.60%; Prior 16.26%

0800 (approx.) Sweden Overall Sentiment for Jan: Prior 95.6

0800 (approx.) Sweden Consumer Confidence SA for Jan: Prior 92.3

0800 (approx.) Sweden Manufacturing Confidence for Jan: Prior 106.9

0800 (approx.) Sweden Total Industry Sentiment for Jan: Prior 92.6

0830 Sweden Retail Sales MM for Dec: Prior 0.8%

0830 Sweden Retail Sales YY for Dec: Prior 5.7%

0830 Sweden Unemployment Rate for Dec: Prior 7.7%

0830 Sweden Unemployment Rate SA for Dec: Prior 8.3%

0830 Sweden Total Employment for Dec: Prior 5.062 mln

0900 (approx.) Germany BW State CPI MM for Jan: Prior 0.6%

0900 (approx.) Germany BW State CPI YY for Jan: Prior 0.1%

0900 Germany BY State CPI MM for Jan: Prior 0.4%

0900 Germany BY State CPI YY for Jan: Prior -0.3%

0900 (approx.) Germany HE State CPI MM for Jan: Prior 0.6%

0900 (approx.) Germany HE State CPI YY for Jan: Prior -0.5%

0900 Italy Manufacturing Business Confidence for Jan: Expected 95.6; Prior 95.9

0900 Italy Consumer Confidence for Jan: Expected 100.5; Prior 102.4

0930 (approx.) Portugal Business Confidence for Jan: Prior -0.10

0930 (approx.) Portugal Consumer Confidence for Jan: Prior -26.20

1000 (approx.) Euro Zone Business Climate for Jan: Prior -0.41

1000 Euro Zone Economic Sentiment for Jan: Expected 89.5; Prior 90.4

1000 Euro Zone Industrial Sentiment for Jan: Expected -7.2; Prior -7.2

1000 Euro Zone Services Sentiment for Jan: Expected -18.8; Prior -17.4

1000 Euro Zone Consumer Confidence Final for Jan: Expected -15.5; Prior -15.5

1000 Euro Zone Consumer Influence Expected for Jan: Prior 14.8

1000 Euro Zone Selling Price Expected for Jan: Prior 4.1

1030 (approx.) Belgium CPI MM for Jan: Prior 0.03%

1030 (approx.) Belgium CPI YY for Jan: Prior 0.41%

1300 (approx.) Germany CPI Prelim MM for Jan: Expected 0.4%; Prior 0.5%

1300 (approx.) Germany CPI Prelim YY for Jan: Expected 0.7%; Prior -0.3%

1300 (approx.) Germany HICP Prelim MM for Jan: Expected 0.3%; Prior 0.6%

1300 (approx.) Germany HICP Prelim YY for Jan: Expected 0.5%; Prior -0.7%

1300 (approx.) Germany NW State CPI MM for Jan: Prior 0.5%

1300 (approx.) Germany NW State CPI YY for Jan: Prior -0.4%