Liveblog Archief donderdag 1 april 2021

TA 6

Vandaag zes grafieken, ze maken allemaal onderdeel uit van de AEX. Aan bod komen bijvoorbeeld DSM, ING en IMCD. Als vervolg op de diepteanalyse van de AEX van afgelopen dinsdag kijk ik ook nog even naar de AEX.Zullen we er maar direct mee beginnen. met die AEX? Het is meer een update dan een…

Lees verder »Markt snapshot Wall Street 1 april

TOP NEWS

• Global factory recovery picks up, but cost pressures grow

Factories across Europe and Asia ramped up production in March as a solid recovery in demand helped manufacturers move past the setbacks of the pandemic, although escalating costs and supply- chain disruptions were creating challenges and driving prices.

• Global M&A sets Q1 record as dealmakers shape post-COVID world

Mergers and acquisitions activity surged globally in the first quarter of 2021 to a year-to-date record, as companies and investment firms rushed to get ahead of changes in how people work, shop, trade and receive healthcare during the COVID-19 pandemic.

• Pfizer COVID-19 shot 91% effective in updated data, protective against South African variantPfizer and BioNTech said their COVID-19 vaccine is around 91% effective at preventing the disease, citing updated trial data that included participants inoculated for up to six months.

• U.S. resumes calls to Saudi as OPEC+ debates increase or rollover

The United States said in call with Saudi Arabia that energy should be kept affordable for consumers, as the administration of President Joe Biden resumed the practice of his predecessor Donald Trump who contacted OPEC's leader before key meetings.

• J&J finds problem with COVID vaccine batch; NYTimes says 15 million doses ruined

Johnson & Johnson said on Wednesday it had found a problem with a batch of the drug substance for its COVID-19 vaccine being produced by Emergent Biosolutions, and said the batch did not advance to the final fill-and-finish stage.

BEFORE THE BELL

Wall Street futures were in green as chipmakers gained, while investors awaited weekly jobless claims data.European stocks traded higher, shrugging off concerns over another lockdown order in France. Japan's Nikkeiended higher with focus on semiconductor outlook and hopes over roboust corporate earnings. Gold prices rose as yields eased and the dollar slipped. Oil rise on hopes that OPEC and its allies will keep production curbs in place when they meet. Data for weekly jobless claims and manufacturing are scheduled for release.

STOCKS TO WATCH

Results

• Micron Technology: The chipmaker on Wednesday forecast fiscal third-quarter revenue above Wall Street estimates due to a rise in demand for memory chips thanks to 5G smartphones and artificial intelligence software that is pushing memory chip prices upward. The chipmaker expects current-quarter revenue to be $7.1 billion, plus or minus $200 million, while analysts on average were expecting $6.79 billion. The company's revenue for the fiscal second quarter ended March 4 rose to $6.24 billion, beating estimates of $6.21 billion. Second-quarter adjusted profit was 98 cents per share, beating analyst expectations of 95 cents per share.

In Other News

• Abbott Laboratories: The Illinois-based company said on Wednesday that U.S. regulators have cleared its rapid COVID-19 antigen test for over-the-counter, at-home use in people without symptoms, making the cheap and abundant tests more easily available for regular screening at schools and workplaces. The company said it will begin shipping its BinaxNOW test to retailers in the coming weeks. It is among the most widely available COVID-19 tests in the United States and produces results in around 15 minutes. People will be able to purchase tests at stores or online without a prescription and administer them at home. Abbott is still determining the exact price of the test when sold over-the-counter, though it will sell them to retailers for less than $10 each, a spokeswoman told Reuters.

• Astrazeneca PLC: Japan's first doses of AstraZeneca's COVID-19 vaccine are coming from plants in the United States, not Europe as initially expected, the company told the Asahi Newspaper. The company had intended to import the undiluted vaccine from Europe until export controls were tightened there at the end of January, AstraZeneca's head of vaccines in Japan, Tomoo Tanaka, said in an interview. An AstraZeneca spokeswoman confirmed the details when contacted by Reuters. Supplies of the vaccine will gradually shift to those made domestically by Japanese companies once regulatory approval is granted, expected in May, Tanaka said. He did not give details on the current inventory of doses.

• Boeing Co: The Federal Aviation Administration (FAA) said on Wednesday it had approved the design for the Boeing 737-8200, part of the Boeing 737 MAX series, a necessary step before the U.S. planemaker can begin delivering the higher-capacity airplanes to Ryanair. The FAA said the 737-8200 incorporates all of the design improvements that were part the 20-month review of the 737 MAX that led to the ungrounding of the MAX in November, more than a year after two fatal crashes killed 346 people. Boeing said Wednesday it would "continue to work with global regulators to safely return the 737-8 and -9 to service. Separately, Fiji Airways said it had received approval from its national aviation regulator to return its Boeing 737 MAX planes to service after a two-year grounding following two deadly crashes.

• Carlyle Group Inc & Occidental Petroleum Corp: Boru Energy, backed by private equity giant Carlyle Group, is in discussions with Occidental to acquire its oil and gas fields in Ghana for around $500 million, industry and banking sources said. The acquisition of Occidental's stakes in the offshore Jubilee and Tweneboa Enyenra Ntomme (TEN) fields would be the first investment for Boru Energy, led by former Tullow Oil CEO Aidan Heavey, which Carlyle's international energy fund CIEP launched in 2019. It would also mark a symbolic moment for Heavey, who founded Tullow Oil in 1985 and who oversaw the development of the Jubilee field which started production in 2010 before stepping down in 2013 after missing production targets. Carlyle and Boru Energy declined to comment. Occidental, which had previously said it was seeking to sell its Ghanaian assets, declined to comment.

• Credit Suisse Group AG: The Swiss bank plans to return more cash to investors in supply chain finance funds linked to stricken Greensill in early to mid-April, it said. "Over time, we expect the majority part of the funds' investments to be recovered in the liquidation process, and we have recourse to other measures should they be necessary, including possible legal action. We continue to explore other options for expediting the return of cash to investors," it said in a notice to investors dated March 31 and posted on its website. The bank had also suspended four other Credit Suisse Asset Management (CSAM) funds that had invested in the supply chain finance funds. To reopen these funds for valuation, subscriptions and redemptions, the illiquid part of the funds' assets will be separated and "side pockets" will be created, it said. For this illiquid part, clients will receive a separate share class. The side pocket share classes will be subsequently liquidated and paid out in cash.

• Exxon Mobil Corp: The largest U.S. oil producer could post its first profit in five quarters on improved results across its businesses, with higher oil and gas prices providing a lift of as much as $2.7 billion, offset by costs from a February deep freeze. The February freeze that cut power to Texas refineries and chemical plants, and curbed oil and gas supplies, caused up to $800 million in damages and lost production volumes, Exxon indicated. The filing showed refining remains a troubled business despite sequentially improved operating margins. Refineries have been especially hard hit by a pandemic-related drop in fuel demand and a recent rise in feedstock prices. Exxon's chemicals operation, its only business to eke out a profit for 2020, could get a $600 million boost over fourth quarter results on better margins. Meanwhile, Exxon's CEO Darren Woods told employees the company expects to restore its contribution to the U.S. employee retirement savings plan this year and does not plan another major set of layoffs.

• Ford Motor Co: The carmaker and Mahindra & Mahindra will not collaborate on any project they had agreed to as part of their abandoned joint venture in India, the companies said. Ford and Mahindra had proposed a joint venture to develop at least three sport-utility vehicles (SUVs) for India and emerging markets, as well as share suppliers, powertrains and technology. The deal, which would have ended most of Ford's independent operations in India, was called off on Dec. 31. "As part of winding down our relationship, several cooperative product programmes will no longer proceed. We are currently re-scoping those product programmes," a Ford India spokesman said in a statement. Ford has previously said that its independent India operations will continue.

• Hershey Co, Mondelez International Inc & Pinterest Inc: The chocolate makers say they've turned to social media platforms like Pinterest to look for clues on which products might sell best during the pandemic U.S. Easter season. About a month before Easter, people posted images of do-it-yourself Easter cookie kits and Easter baskets on Pinterest, according to Hershey Co's research. The Pennsylvania-based chocolate company found that searches for those products on Pinterest increased in early March, with search volumes for related hashtags increasing more than 1,000% year-over-year. Based on the trend, Hershey moved quickly to add recipes incorporating Hershey Cadbury crème eggs and Hershey chocolate syrup to the company’s own "Easter" and "Cakes and Cupcakes" boards on Pinterest.

• International Business Machines Corp: Celonis, a fast-growing German process mining software startup, has struck a strategic partnership with IBM to help companies make the most of the digital transformation that many are undergoing at speed. IBM's Global Business Services consulting arm will weave the Celonis Execution Management System into its offering, adding the ability to analyse data thrown off by processes like supply-chain management, finance or procurement to identify weaknesses and recommend fixes. Celonis will also shift its software stack to IBM's Red Hat OpenShift platform, which enables companies to operate in an open 'hybrid' setting that can include public or private cloud data centres, on-premise servers and mainframe computers. Weaving Celonis into IBM's consulting offering can help clients to identify where the value can be found across a range of applications, making it possible to benchmark performance, deploy artificial intelligence or trigger automation.

• Johnson & Johnson: The company said on Wednesday it had found a problem with a batch of the drug substance for its COVID-19 vaccine being produced by Emergent Biosolutions, and said the batch did not advance to the final fill-and-finish stage. J&J did not say how many vaccine doses the batch would have produced. The New York Times reported that about 15 million doses were ruined, without citing a source. The Times said that workers had conflated ingredients for the J&J vaccine and a coronavirus vaccine developed by AstraZeneca, which is produced at the same plant, several weeks ago. The manufacturing misstep follows manufacturing issues at J&J, which is seen as one of the most important COVID-19 vaccines globally, because its vaccine is a single dose and requires relatively little special handling.

• Mastercard Inc: The global payment processor will invest $100 million in Airtel Africa's mobile money operations, valuing the business at $2.65 billion, the London-listed company said. Mastercard will hold a minority stake in AMC BV, in line with Airtel Africa's plan to monetise the mobile money business by selling up to a 25% stake in the unit, the company said. The unit, operating under the Airtel Money brand in Africa, includes mobile wallets, merchant and commercial payments, virtual credit card and international money transfers available across 14 countries in the region. Airtel Africa, which offers Airtel Money in Nigeria in partnership with a local bank, said it aims to have all mobile money operations to be owned and operated by AMC BV.

• Micron Technology Inc & Western Digital Corp: The companies are individually exploring a potential deal for Kioxia Holdings that could value the Japanese semiconductor firm at around $30 billion, the Wall Street Journal reported on Wednesday, citing people familiar with the matter. A deal for Kioxia, which is controlled by private-equity firm Bain Capital, isn't guaranteed, and it isn't clear how it might be structured, the report said, adding that should a deal come together, it could be finalized later this spring. Micron and Western Digital's move comes at a time when the COVID-19 pandemic and disputes over trade and technology between Washington and Beijing have cast a shadow over the global chip industry and affected companies across the supply chain. According the WSJ report, an IPO later this year is still a possibility should Kioxia fail to reach a deal with one of the suitors.

• Pfizer Inc & BioNTech SE: The drugmakers said their COVID-19 vaccine is around 91% effective at preventing the disease, citing updated trial data that included participants inoculated for up to six months. The shot was also 100% effective in preventing illness among trial participants in South Africa, where a new variant called B1351 is dominant, although the number of those participants was relatively small at 800. While the new overall efficacy rate of 91.3% is lower than the 95% originally reported in November for its 44,000-person trial, a number of variants have become more prevalent around the world since then. Pfizer's Chief Executive Officer Albert Bourla said the updated results, which includes data on more than 12,000 people fully inoculated for at least six months, positions the drugmakers to submit for full U.S. regulatory approval. • Stellantis NV: The world's fourth largest carmaker is looking at nearly tripling its global sales of electric vehicles this year, the head of holding company Exor, the company's main shareholder, said. The company targets global sales of 400,000 high voltage vehicles this year from 139,000 in 2020 thanks to the launch of 11 additional models, John Elkann, who also serves as Stellantis chairman, said in a letter to Exor shareholders. Stellantis, formed in January by merging Italian-American Fiat Chrysler and France's PSA, wants to exploit its size to take on rivals in the race to produce more electric vehicles.

• Taiwan Semiconductor Manufacturing Co Ltd: The contract chipmaker said it plans to invest $100 billion over the next three years to increase capacity at its plants, days after Intel announced a $20 billion plan to expand its advanced chip making capacity. The move comes as global companies reel from a shortage of semiconductor chips that initially forced auto companies to cut production, but is now hurting makers of smartphones, laptops and even appliances amid a pandemic-fuelled rise in demand. "We are entering a period of higher growth as the multiyear megatrends of 5G and high-performance computing are expected to fuel strong demand for our semiconductor technologies in the next several years," TSMC said in a statement to Reuters. "In addition, the COVID-19 pandemic also accelerates digitalization in every aspect," it said.

• Telsa Inc: A Volkswagen joint venture in China has agreed to buy green car credits from Tesla to help meet local environmental rules, three people briefed on the matter told Reuters. The deal, the first of its kind to be reported between the two companies in China, highlights the scale of the task Volkswagen faces in transforming its huge petrol carmaking business into a leader in electric vehicles to rival Tesla. To help meet increasingly tough targets, Volkswagen's joint venture with state-owned Chinese automaker FAW, or FAW-Volkswagen, has agreed to buy credits from Tesla, the sources said, declining to be named as the talks were private. Volkswagen declined to comment on the deal. It said in a statement it was "strategically targeting to be self-compliant" with rules in China, but that if required it would buy credits.

• T-Mobile US Inc: Deutsche Telekom expects to secure direct ownership control over T-Mobile, funded by significant capital return to shareholders by its U.S. business, CEO Tim Hoettges told shareholders. In prepared remarks to the annual shareholders meeting, Hoettges said he expected T-Mobile to return up to $60 billion to shareholders between 2023 and 2025. With its share of proceeds, Deutsche Telekom would be able to raise its holding in T-Mobile to over 50% from 43% now, at a strike price below current market levels secured with options, he added. He said that the task first will be to reduce group debts of around $141 billion that increased as a result of T-Mobile's takeover of smaller rival Sprint that closed a year ago.

• Verizon Communications Inc: The U.S. telecom company signed its first private 5G contract in Europe with Associated British Ports (ABP) to deploy the mobile network at the Port of Southampton. Port of Southampton, on England's south coast, is one of the largest ports for cars and cruises, handling about 900,000 cars and millions of cruise passengers annually. It will also become the first mainland port in the UK to have private 5G. The new tech will help the port to enable the use of real-time analytics, asset tracking, autonomous guided vehicles and safety monitoring. "We have been able to equip ABP to take advantage of the immediate benefits private 5G offers, and ... take full advantage of new technology applications and real-time analytics which will digitally transform its services in the future," said Tami Erwin, CEO, Verizon Business.

INSIGHT

Auto industry rethinks cost-cutting playbook as COVID-19, chip shortages disrupt supply chains

After a year of getting hammered by the pandemic, a semiconductor shortage and storms that snarled Dana Inc's global supply chain, the auto parts maker is reaching for a new playbook.

ANALYSTS' RECOMMENDATION

• American International Group Inc: RBC raises target price to $52 from $49, reflecting an improved interest rate outlook.

• Netflix Inc: Piper Sandler assumes coverage with overweight rating and $605 target price, reflecting consistent subscriber gains, modest price increases and quality original content production.

• Uber Technologies Inc: Jefferies initiates coverage with buy rating, expecting mobility bookings to grow with pent-up demand for business rides along with travel boost

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0730 Challenger layoffs for Mar: Prior 34,531

0830 (approx.) Initial jobless claim: Expected 680,000; Prior 684,000

0830 (approx.) Jobless claim 4week average: Prior 736,000

0830 (approx.) Continued jobless claim: Expected 3.775 mln; Prior 3.870 mln

0945 Markit Manufacturing PMI Final for Mar: Prior 59.0

1000 (approx.) Construction spending mm for Feb: Expected -1.0%; Prior 1.7%

1000 ISM Manufacturing PMI for Mar: Expected 61.3; Prior 60.8

1000 ISM Manufacturing Prices Paid for Mar: Expected 85.0; Prior 86.0

1000 ISM Manufacturing Employment Index for Mar: Prior 54.4

1000 ISM Manufacturing New Orders Index for Mar: Prior 64.8

COMPANIES REPORTING RESULTSNo major companies scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0900 Carmax Inc: Q4 earnings conference call

1500 Ciena Corp: Annual Shareholders Meeting

EX-DIVIDENDS

Brixmor Property Group Inc: Amount $0.21

Hannon Armstrong Sustainable Infrastructure Capital Inc: Amount $0.35

Helios Technologies Inc: Amount $0.09

KBR Inc: Amount $0.11

New Residential Investment Corp: Amount $0.20

Omega Flex Inc: Amount $0.28

Ready Capital Corp: Amount $0.10

Roper Technologies Inc: Amount $0.56

Steelcase Inc: Amount $0.10

Toro Co: Amount $0.26

TTEC Holdings Inc: Amount $0.43

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Productie Inkoopmanagersindex (PMI) (Mar) | Actueel: 66,6 Verwacht: 66,6 Vorige: 60,7 |

Wake-up call: Laatste beursdag van de week, divergentie opnieuw merkbaar

Indicatie markt:

Wall Street sluit dan maar weer eens verdeeld ofwel met divergentie tussen traditioneel en de tech sector. Deze keer deden de grote tech aandelen wel volop mee, de TOP 8 aandelen zoals Microsoft, Amazon, Tesla, Apple en Nvidia winnen tussen de 2% en 5% en bepalen dus vooral het verloop van de Nasdaq en de Nasdaq 100 die beiden met 1,5% omhoog gingen. De SOX index won zelfs 2,6%. Kijken we naar de Dow Jones dan verloor deze index 0,25% terwijl de SP 500 wel nog 0,35% hoger geraakte op slotbasis. Het woord wat blijft hangen momenteel op Wall Street is Rente, gisteren eerst weer behoorlijk wat hoger, nu werd er weer iets ingeleverd. Wel blijft de trend van de rente omhoog gericht zolang er nieuwe toppen komen.

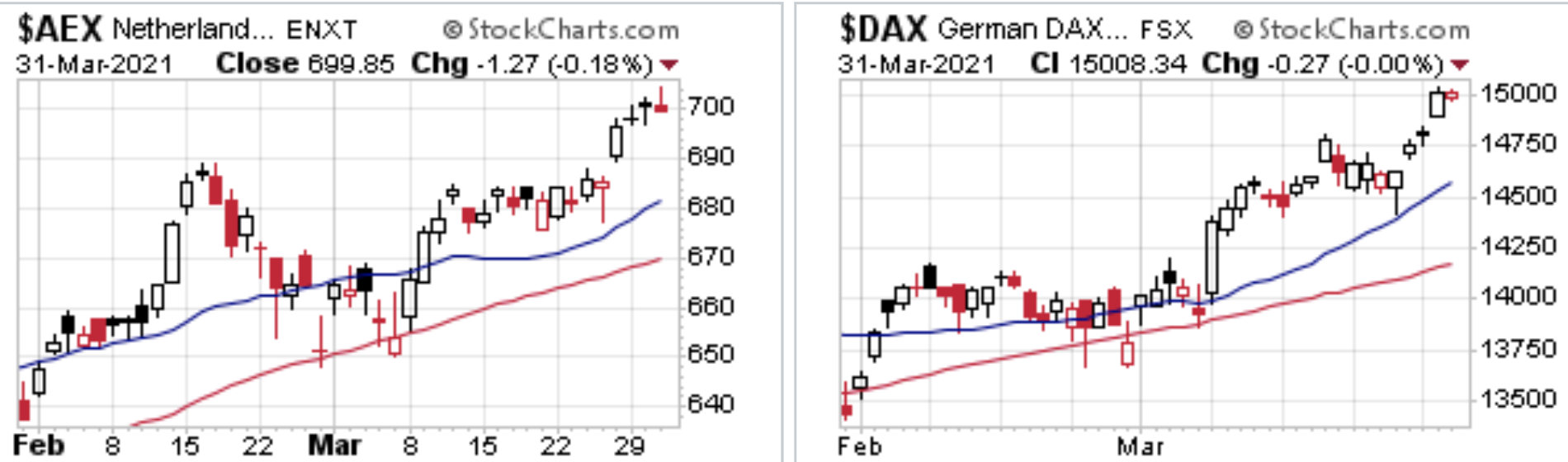

Bij de AEX en de DAX gebeurde er niet zoveel gisteren, de DAX blijf onveranderd net iets boven de 15.000 punten terwijl de AEX een punt moest inleveren om net onder de 700 punten te sluiten. Vandaag al de laatste dag van de beursweek, maandag blijven we in Europa ook dicht door het lange Paas weekend. Wall Street is morgen ook dicht maar op 2e Pasen wel open. De vraag is nu hoe de markten gaan sluiten vandaag en vooral hoe het zal verlopen na het lange weekend.

Resultaat dit jaar 2021 verloopt naar wens:

Enkele van de posities die open stonden werden gesloten de afgelopen dagen zodat we ook de maand maart positief kunnen afronden. Met de maand december erbij komen we nu uit op 4 maanden na elkaar dat er winst werd behaald. Deze manier van werken wil ik aanhouden, de markt krijg ik in ieder geval steeds meer onder controle en probeer met kleine posities goed voor de dag te komen en dat in beide richtingen waar dat kan. Voor de komende maand zie ik weer genoeg mogelijkheden om op te handelen. Na het Paasweekend waar we met de maand april starten heb ik een bepaalde visie waar we iets moois mee kunnen doen !!

Onderaan deze update ziet u nog een overzicht met wat we deze maand en dit jaar hebben behaald wat betreft het resultaat via de signalen die we naar onze leden versturen. Verder ziet u nog de speciale PAAS weekend aanbieding om mee te doen met onze signalen tot 1 JUNI. Via de site en dan de Tradershop kunt u als lid de lopende posities met alle details altijd inzien via https://www.usmarkets.nl/tradershop

Technische conditie Wall Street:

Wat betreft Wall Street zien we dat de Dow Jones en de S&P 500 nog altijd dicht bij hun records blijven hangen wat wil zeggen dat het er technisch nog altijd goed uitziet. Pas als de indices nu 2 tot 3% inleveren moeten we ons zorgen beginnen te maken voor het vervolg op de korte termijn. De Dow Jones en de S&P 500 blijven in ieder geval ook nog ruim boven hun 20-MA en 50-MA (MA = daags gemiddelde) en staan nu al een hele lange periode boven hun 200-MA.

De technologie indices (de Nasdaq, de Nasdaq 100 en de SOX index) blijven maar worstelen om zich verder te herpakken. Ze blijven rond dat 20-MA draaien maar willen er blijkbaar ook niet echt duidelijk van weglopen. De tech indices proberen telkens wel weer op te krabbelen maar krijgen de belangrijke frontrunners van eerder nog niet echt duidelijk mee, niet allemaal gelijktijdig in ieder geval. Gisteren (woensdag) wel weer een sterke dag en dan zie jet meteen dat het komt door die TOP-8 aandelen waar ik het altijd over heb. Nu kwamen ze wel goed op gang en zetten een sterke sessie neer. Wel op de 50-MA letten dat wat hoger uitkomt, we zien het 50-MA bij de Nasdaq rond de 13.430 punten.

Technische conditie AEX en DAX:

AEX index:

We zien zowel op de korte als op de langere termijn een uitbraak sinds vorige week vrijdag bij de AEX index, het wachten tussen de pakweg 675 en 687 punten duurde al lang genoeg want de index bleef daartussen zo'n 10 dagen hangen binnen een range van 12 punten, de top van midden februari rond de 688-690 punten doemde daar steeds op als zware hindernis. Vorige week vrijdag zijn we er eindelijk boven geraakt via de uitbraak en die was meteen behoorlijk krachtig. Je kon er ook al op wachten omdat de index in de 10 dagen binnen die genoemde range van ongeveer 12 punten geen enkele keer de intentie had om zwaar onderuit te gaan terwijl alle kansen daartoe wel aanwezig waren.

Nu de index boven die zware weerstand geraakt en die blijkbaar ook makkelijk achter zich lijkt te laten ziet er goed en sterk uit voor wat betreft de AEX. Deze week kwam er al een test van het oude record op 703 punten dat werd bereikt in 2000 ofwel maar liefst bijna 21 jaar geleden. De index geraakt nog niet boven deze zware weerstand voorlopig, er kan eerst een terugtest komen van de 688-690 punten voor er een nieuwe en mogelijk meer krachtige aanval komt op die 703 punten weerstand. Bij een uitbraak zie ik mogelijkheden richting de 712 en de 725 punten.

DAX index:

De DAX doet het nog altijd goed en blijft op slotbasis rond de hoogste stand ooit hangen, de uptrend bij de DAX blijft duidelijk, het doel rond die 15.000 punten werd behaald. De volgende richtpunten zijn nu eerst de 15.150 en de 15.250 punten mocht de index verder oplopen. Aan de andere kant zijn vrijwel alle indices, dus ook de DAX, rijp voor een grotere correctie. Steun nu rond het 20-MA dat nu rond de 14.580 punten uitkomt, later de 14.400 punten (recente bodems) en de 14.175 punten waar we het 50-MA zien uitkomen als steun. Er is zoals u merkt meer dan genoeg ruimte omlaag voor wat betreft de DAX voor dat de index in de problemen komt. Even een terugval lijkt me nu logisch, daarna kan er een nieuwe stijging op gang komen richting weer nieuwe records.

Euro, olie en goud:

De euro zien we nu rond de 1.172 dollar, de prijs van een vat Brent olie komt uit op 63,1 dollar terwijl een troy ounce goud nu op 1712 dollar staat.

Resultaat dit jaar 2021 verloopt naar wens:

Onderaan deze update ziet u nog een overzicht wat betreft Trading met een mooie Paasweekend aanbieding om mee te doen met onze signalen tot 1 JUNI. Via de site en dan de Tradershop kunt u de posities met alle details zien staan. https://www.usmarkets.nl/tradershop

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Inter Market overzicht op slotbasis ...

Nu lid worden tot 1 JUNI voor €29?

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook deze maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 JUNI en dat met een mooie korting !! ... €29 tot 1 JUNI 2021 ... en voor Polleke €39 tot 1 JUNI 2021 !!! https://www.usmarkets.nl/tradershop

Schrijf u in voor Systeem Trading (€29 tot 1 JUNI)

Schrijf u in voor Index Trading (€29 tot 1 JUNI)

Schrijf u in voor Guy Trading (€29 tot 1 JUNI)

Schrijf u in voor Polleke Trading (€39 tot 1 JUNI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 JUNI)

Schrijf u in voor COMBI TRADING (€50 tot 1 JUNI)

Hieronder de resultaten deze maand en dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 1 april

GLOBAL TOP NEWS

Asia's factories stepped up production in March as a solid recovery in global demand helped manufacturers move past the setbacks of the pandemic, although rising costs are creating new challenges for businesses in the region.

President Joe Biden on Wednesday called for a sweeping use of government power to reshape the world's largest economy and counter China's rise in a $2 trillion-plus proposal that was met with swift Republican resistance.

Contract chipmaker TSMC said it plans to invest $100 billion over the next three years to increase capacity at its plants, days after Intel announced a $20 billion plan to expand its advanced chip making capacity.

EUROPEAN COMPANY NEWS

Investors on Wednesday tallied the fallout from Archegos Capital’s dramatic meltdown, with Nomura and Credit Suisse shares losing a collective $9 billion while heightened scrutiny of the hedge fund industry loomed.

Italy is considering a less expensive route to win control of broadband operator Open Fiber, three sources familiar with the matter said on Wednesday, as it looks to play a steering role to boost connectivity across the country.

A consortium of investors led by Italian state lender Cassa Depositi e Prestiti (CDP) said on Wednesday it had approved a sweetened offer for Atlantia's 88% stake in motorway unit Autostrade per l'Italia.

TODAY'S COMPANY ANNOUNCEMENTS

Deutsche Telekom AG Annual Shareholders Meeting

Forbo Holding AG Annual Shareholders Meeting

Next PLC Preliminary Q4 2020 Earnings Release

Sodexo SA HY 2021 Earnings Call

St Modwen Properties PLC Annual Shareholders Meeting

WM Capital SpA Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 (approx.) Germany Retail Sales mm Real for Feb: Expected 2.0%; Prior -4.5%

0600 (approx.) Germany Retail Sales yy Real for Feb: Expected -6.3%; Prior -8.7%

0630 Switzerland CPI mm for Mar: Expected 0.4%; Prior 0.2%

0630 Switzerland CPI yy for Mar: Expected -0.3%; Prior -0.5%

0630 (approx.) Switzerland CPI NSA for Mar: Prior 100.2

0630 Switzerland Retail Sales yy for Feb: Prior -0.5%

0630 (approx.) Sweden PMI Manufacturing Sector for Mar: Expected 62.5; Prior 61.6

0700 (approx.) Netherlands PMI - Manufacturing for Mar: Prior 59.6

0700 (approx.) Austria Unemployment for Mar: Prior 437,000

0700 (approx.) Austria Unemployment Rate for Mar: Prior 10.7%

0715 Spain Manufacturing PMI for Mar: Expected 56.0; Prior 52.9

0730 Switzerland Manufacturing PMI for Mar: Expected 64.5; Prior 61.3

0745 Italy Markit/IHS Manufacturing PMI for Mar: Expected 59.8; Prior 56.9

0750 France Markit Manufacturing PMI for Mar: Expected 58.8; Prior 58.8

0755 Germany Markit/BME Manufacturing PMI for Mar: Expected 66.6; Prior 66.6

0800 (approx.) Spain Car Registration mm for Mar: Prior 38.9%

0800 (approx.) Spain Car Registration yy for Mar: Prior -38.4%

0800 Euro Zone Markit Manufacturing Final PMI for Mar: Expected 62.4; Prior 62.4

0830 United Kingdom Markit/CIPS Manufacturing PMI Final for Mar: Expected 57.9; Prior 57.9