Liveblog Archief donderdag 23 juli 2020

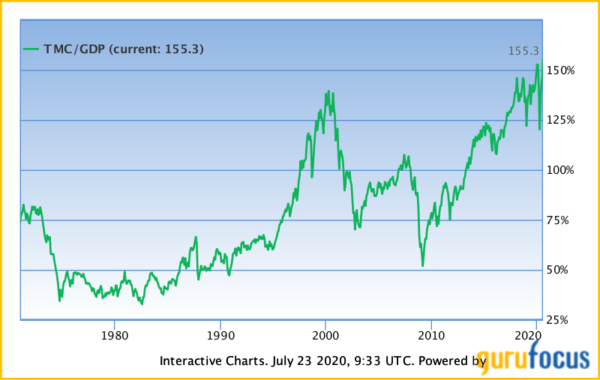

Gisteren na het slot op Wall Street staat de marktkapitalisatie op maar liefst 155,3% ten opzichte van het BBP met nog steeds een negatieve winstgroei ... Mijn inziens de grootste financiële zeepbel ooit maar nogmaals ... wie ben ik ???

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 1.416K Verwacht: 1.300K Vorige: 1.307K |

Markt snapshot Wall Street pre market

TOP NEWS

• Twitter misses quarterly ad sales estimates while usage surges

Twitter missed Wall Street's lowered expectations for quarterly revenue despite surging usage, as the coronavirus-spurred economic slowdown battered the company's largely events-oriented digital ads business.

• China says it will be forced to respond to Houston consulate closure

China warned it will be forced to respond after the United States ordered the shutdown of its Houston consulate, a move the Chinese Foreign Ministry said had "severely harmed" relations.

• AT&T loses monthly subscribers as media unit takes a hit from COVID-19

AT&T said it lost monthly phone subscribers and suffered a $2 billion revenue decline from delayed movie releases and advertising shortfalls in the second quarter as the COVID-19 pandemic ravaged its business.

• Southwest posts $915 million loss in second quarter, warns of more COVID-19 pain

Southwest Airlines warned that travel demand would remain depressed until a vaccine or treatment for COVID-19 becomes available, as it posted a $915 million loss for the second quarter.

• Big Tech CEOs ready defenses for U.S. Congress hearing into their growing power

The chief executives of four of the largest U.S. tech companies plan to deflect criticism next week in a Congressional hearing into their use of market power to hurt rivals by saying they themselves face competition and by debunking claims they are so dominant.

BEFORE THE BELL

U.S. stock index futures were in the green, buoyed by hopes of a new COVID-19 stimulus package, even as investors awaited the weekly jobless claims numbers. Upbeat earnings lifted European equities, while Asian shares mostly closed lower as escalating U.S.-China tensions weighed on sentiment. The dollar index hit four-month lows, which helped gold extend its rally. Oil prices dropped on concerns about increasing U.S. crude inventories. Intel, T-Mobile US and Mattel are expected to report their earnings after markets close.

STOCKS TO WATCH

Results

• AT&T Inc (T). The media and telecommunications company said it lost monthly phone subscribers and suffered a $2 billion revenue decline from delayed movie releases and advertising shortfalls in the second quarter as the COVID-19 pandemic ravaged its business. AT&T lost 151,000 postpaid mobile phone subscribers in the quarter, including about 338,000 customers who stopped paying but were kept on the network. Analysts had expected the company to add 6,800 subscribers. Total quarterly revenue fell nearly 9% to $41 billion. Analysts on average had expected $41.10 billion.

• Cenovus Energy Inc (CVE). The Canadian oil and gas producer posted a second-quarter loss and said the worst was behind the industry after the COVID-19 pandemic hammered global demand for crude oil and refined products. The company recorded a net loss of C$235 million, or 19 Canadian cents per share, for the second quarter ended June 30, from a year ago profit of C$1.78 billion, or C$1.45 per share. On an adjusted basis, it posted a loss of 34 Canadian cents per share, smaller than the average analyst estimate of 54 Canadian cents per share.

• Chipotle Mexican Grill Inc (CMG). The Mexican fast-casual chain beat Wall Street expectations for second-quarter earnings on Wednesday, as soaring digital sales helped it recover amid the coronavirus crisis and continue the performance that boosted its share price 40% so far this year. Digital sales for the quarter grew 216% to nearly 61% of total sales. Overall comparable sales were 9.8% lower for the quarter ended June 30 but have turned positive, up 6.4% so far in July. Total revenue fell 4.8% to $1.36 billion, its first decline in at least 14 quarters but still beating Wall Street estimates of $1.34 billion. Excluding one-time items, the fast-casual chain earned 40 cents per share, beating average analysts' estimates of 35 cents.

• CSX Corp (CSX). The railroad operator reported on Wednesday a drop in quarterly profit after cost controls failed to offset a 20% volume slump from the COVID-19 pandemic that now threatens to derail the fragile U.S. economic recovery. The Jacksonville, Florida-based company reported second-quarter net income of $499 million, or 65 cents per share, down from $870 million, or $1.08 per share, a year earlier. Revenue tumbled 26% - the largest decline in company history - to $2.26 billion after the automotive segment led across-the-board declines. Profit for the quarter was a penny per share better than Wall Street analysts expected, but revenue just matched estimates.

• Kinder Morgan Inc (KMI). The pipeline operator on Wednesday posted a second straight quarterly loss as it took a $1-billion impairment charge after a steep fall in natural gas prices caused by the coronavirus crisis hurt the value of some of its assets. Net loss attributable to the company stood at $637 million, or 28 cents per share, in the second quarter ended June 30, compared with a profit of $518 million, or 23 cents per share, a year earlier. Excluding items, the company reported a profit of 17 cents per share, in-line with Wall Street estimates.

• LG Display Co Ltd (LPL). The South Korean panel maker said it expects profitability to improve in the second half of this year, despite a larger operating loss as people shied away from buying TV sets during the coronavirus pandemic. Its loss for April-June widened to 517 billion won from a loss of 369 billion won in the same period a year earlier. Revenue fell 1% to 5.3 trillion won, the company said in a regulatory filing. "Considering the prolonged COVID-19 pandemic, it is true that the macroeconomic environment is still not favourable. However, we observe that the worst is over," said Suh Dong-hee, chief financial officer and senior vice president.

• Microsoft Corp (MSFT). The company's flagship cloud computing business Azure reported quarterly sales growth of under 50% for the first time ever on Wednesday, sending the tech giant's shares down 2%. Revenue in Microsoft's Intelligent Cloud segment rose 17% to $13.4 billion, with 47% growth in the Azure component, which includes essential computing and storage services. Analysts on average had expected cloud revenue of $13.09 billion in the fourth quarter ended June 30. Microsoft's total revenue rose 13% to $38.03 billion in the quarter, beating estimates of $36.5 billion. Net income fell to $11.20 billion, or $1.46 per share, from $13.19 billion, or $1.71 per share, a year earlier.

• Relx PLC (RELX). The European information group said its revenue fell 10% in the first half of 2020 as the coronavirus pandemic forced countries to halt public events and gatherings, hitting the London-listed company's exhibitions arm. The division swung to an adjusted operating loss of 117 million pounds in the six months ended June 30 from a profit of 231 million pounds a year earlier, as the unit's revenue slumped 71%. Revenue fell to 3.50 billion pounds from 3.89 billion pounds a year earlier.

• Southwest Airlines Co (LUV). The airlines warned that travel demand would remain depressed until a vaccine or treatment for COVID-19 becomes available, as it posted a $915 million loss for the second quarter. Dallas-based Southwest posted a net loss of $915 million, or $1.63 per share, for the quarter ended June 30, compared with a profit of $741 million, or $1.37 per share, a year earlier. Excluding items, the loss was $1.5 billion, or $2.67 per share. The airline ended the second quarter with liquidity of $15.5 billion, and said total operating revenue fell 82.9% to $1.01 billion.

• STMicroelectronics NV (STM). The French-Italian chipmaker raised its full-year net revenue guidance, citing improved market conditions, new products and engaged customer programmes. The Geneva-based group reported second-quarter sales above its own guidance, with a 6.5% drop instead of an expected 10.3% decrease, citing a quarter-on-quarter revenues increase in its Microcontrollers segment. STMicro now sees 2020 sales in between $9.25 billion and $9.65 billion, compared with $8.8 billion and $9.5 billion previously. The company expects sales to grow by $610 million to $1.01 billion in the second half of the year, compared to its previous guidance of $340 million to $1.04 billion, with anticipated 17.4% revenue growth in the third-quarter.

• Suncor Energy Inc (SU). The Canadian oil and gas producer posted a bigger-than-expected quarterly loss on Wednesday, as oil prices tumbled on the back of a rapid decline in global demand caused by the coronavirus pandemic. Total production plunged to 655,500 barrels of oil equivalent per day (boepd) during the quarter, from 803,900 boepd a year earlier as the company cut output to keep pace with reduced demand. Suncor reported an operating loss of 98 Canadian cents per share. Analysts on average had projected a loss of 60 Canadian cents per share. The company realized $296 million in hydrocarbon inventory losses in the quarter that were recognized in the preceding quarter.

• Teck Resources Ltd (TECK). The Canadian miner reported a more than 80% fall in second-quarter adjusted profit, as the COVID-19 pandemic hurt demand for its products and squeezed prices. Vancouver-based Teck said adjusted profit attributable to shareholders fell to C$89 million, or C$0.17 per share, in the three months ended June 30, from C$498 million, or C$0.88 per share, a year earlier. Revenue dropped 45% to C$1.72 billion.

• Tesla Inc (TSLA). The carmaker on Wednesday posted a second-quarter profit as cost cuts and strong deliveries helped offset coronavirus-related factory shutdowns, sending its stock up 4.4% in after-hours trading and clearing a hurdle that could lead to the electric carmaker's inclusion in the S&P 500 index. Tesla said it earned net income of $104 million from April to June, or $0.50 per share, marking the first time the company has posted a profit for four straight quarters, a condition for it to be considered for the stock index of the largest U.S. companies. Tesla's second-quarter revenue fell to $6.04 billion from $6.35 billion a year earlier, but surpassed analyst expectations for revenue of $5.37 billion. Tesla reported $5.18 billion in second-quarter automotive revenue, but its share of income from regulatory credits increased to $428 million from $354 million in the first quarter.

• Travelers Cos Inc (TRV). The property and casualty insurer reported a second-quarter loss, hurt by a sharp increase in catastrophe losses and dismal returns on non-fixed income investments in pandemic-hit financial markets. Travelers reported a net loss of $40 million, or 16 cents per share in the second quarter ended June 30, from a profit of $557 million, or $2.10 per share, a year earlier. New York-based Travelers said net written premiums fell 1% to $7.35 billion for the quarter. Travelers reported pre-tax catastrophe losses of $854 million in the quarter, compared to losses of $367 million a year earlier. Net investment income fell 380% to $268 million due to lower returns from its fixed income portfolio business, dented by low interest rates.

• Twitter Inc (TWTR). The social media company missed Wall Street's lowered expectations for quarterly revenue despite surging usage, as the coronavirus-spurred economic slowdown battered the company's largely events-oriented digital ads business. Ad sales, which make up 82% of Twitter's revenue, sank 23% to $562 million, which the company attributed to brand spending pauses tied to the pandemic and U.S. civil unrest. Analysts had expected $585 million. The company clocked its highest-ever yearly growth of daily users who can view ads, increasing 34% to 186 million, above analysts' target of 176 million. Total revenue came in at $683 million, down 19% year-over-year, helped by steadier sales growth from the licensing of users' posts to researchers and marketers. Adjusted to exclude the tax considerations, the company incurred a loss of $127 million, or 16 cents per share, roughly in line with analyst expectations of a $125 million loss.

• Unilever PLC (UL). Second-quarter sales at the consumer goods giant fell much less than expected as a pick up in eating at home during coronavirus lockdowns boosted demand for products such as Knorr soups and Breyers ice cream. Highlighting the huge disruptions caused by the pandemic, Unilever said food service sales declined by nearly 40% and out of home ice cream by nearly 30% in the first half. E-commerce sales, however, leapt 49%. Underlying sales fell 0.3% in the three months ended June 30, compared with analysts' mean forecast for a 4.3% drop. Underlying sales in North America jumped 7.3% in the first half, with volumes up as much as 20% in some categories, Chief Financial Officer Graeme Pitkethly told a media call.

Deals Of The Day

• Walmart Inc (WMT). India's Flipkart said it had acquired parent Walmart's local cash-and-carry business, as the e-commerce firm strengthens its wholesale offerings to compete better with Amazon. The deal will allow Flipkart to launch a digital marketplace called Flipkart Wholesale next month, the Bengaluru-headquartered firm said, without disclosing any financial details of the deal. Walmart India employees will join the Flipkart Group as part of the deal, Flipkart said.

In Other News

• Amazon.com Inc (AMZN). The company's Indian unit said it will begin offering auto insurance, making India the e-commerce giant's first market for the service. Amazon Pay, the India unit's payments arm, has partnered with private firm Acko General Insurance to offer car and motor-bike insurance, the company said in its blog. The insurance is currently available on Amazon's app and mobile website. Customers of Amazon's Prime loyalty programme will get extra benefits and more discounts, Amazon said.

• Carnival Corp (CCL). The cruise operator's Princess Cruises said on Wednesday it would extend the suspension of select voyages through Dec. 15 as it looks to contain the spread of the novel coronavirus. Princess Cruises also said all cruises sailing in and out of Australia on select vessels have been suspended through Oct. 31. However, another Carnival unit, Germany-based AIDA Cruises, said earlier this month it would resume sailing operations in August, introducing a variety of coronavirus preventive measures to complement existing health and hygiene standards.

• Centras Eletricas Brasileiras SA (EBR). Privatizing Brazilian state power company Eletrobras is a priority for the government, the energy minister said on Wednesday, the day after his ministry made public a request for funding to carry out the privatization process. In the documents released Tuesday, the Mines and Energy Ministry requested 4 billion reais ($781 million) in its 2021 budget to create a separate state firm to hold some vestigial Eletrobras assets, should it be privatized. "Within the Pro-Brazil agenda, it's one of the priorities," Mines and Energy Minister Bento Albuquerque told journalists on Wednesday, referring to a federal government program to reignite growth amid the novel coronavirus pandemic. "It's a priority of the government."

• Citigroup Inc (C). An Australian investigator who helped bring criminal cartel charges against Citigroup and Deutsche Bank departed from correct process by sending sensitive documents to his personal email address, a colleague told a court. The disclosure in a pre-trial hearing underscores a key line of defence against the country's biggest white collar criminal case: the investment banks want to show the evidence used to charge them was tainted by departure from due process. Accessing investigation documents stored on a USB stick through a home computer would also be a departure from ACCC guidelines, Won said.

• ConocoPhillips (COP). The U.S. oil major said on Wednesday that it agreed to buy land from Kelt Exploration in Canada's Montney shale oil play, in a $375 million deal. The 140,000 acres in British Columbia are directly adjacent to ConocoPhillips' own Montney lands, the company said. The deal allows ConocoPhillips to extend its existing position at an attractive cost, Chief Operating Officer Matt Fox said. Kelt said in a statement that the sale would strengthen its finances during an uncertain economic time, while leaving it a large inventory of future drilling sites.

• Corteva Inc (CTVA). A U.S. appeals court on Wednesday ruled that the company can continue to sell an agricultural weed killer that environmentalists said was threatening to plants and wildlife. A three-judge panel on the 9th U.S. Circuit Court of Appeals rejected a claim from environmental groups that the U.S. Environmental Protection Agency failed to properly consider the product's volatility, or tendency to evaporate into a gas and drift away. Instead, they said the agency properly relied on studies to conclude that the volatility of 2,4-D choline salt will not cause unreasonable harm to the environment.

• Facebook Inc (FB). A federal appeals court on Wednesday declined to unseal a ruling that let Facebook avoid wiretapping a criminal suspect who was using one of the company's encrypted services. The three-judge panel of the 9th U.S. Circuit Court of Appeals rejected the request by American Civil Liberties Union, the Electronic Frontier Foundation and others that it direct a lower court judge to publish his ruling. The civil liberties groups argued that although wiretap applications typically remain private, judicial opinions are almost always public. They said technology companies had a compelling interest in learning how far federal authorities could go in forcing them to spy on users.

• Ford Motor Co (F). The carmaker's Mexico unit said on Wednesday that a railway blockade in the Mexican border state of Sonora is affecting operations at its Hermosillo plant in the same state, as well as hitting imports and exports to and from the United States. The blockade has hit both the Mexicali-California and the Nogales-Arizona border crossings, and so far prevented the passage of 15 trains carrying about 150,000 tons of cargo, according to the Mexican railways association AMF. AMF President Jose Zozaya estimated it has caused losses of more than $3.4 million. Protesters are demanding the government fulfill commitments to social development throughout indigenous territories, according to EFE news agency.

• Goldman Sachs Group Inc (GS). The company's Chief Executive Officer David Solomon said Wednesday there is "no excuse" why the bank's recruits from top U.S. universities are not more diverse, and said he wants to move faster to increase diversity among the bank's senior ranks. Goldman has set some of the most aggressive and specific goals among the big banks requiring that more Black, Latino and female professionals be interviewed and hired for jobs at the bank. But Solomon said the bank is not increasing diversity fast enough, particularly at the upper echelons. "I'm not pleased with where the senior leadership of the firm is," Solomon said of the bank's predominantly white, male senior ranks.

• Nvidia Corp (NVDA). SoftBank's chip company Arm Holdings has gathered takeover interest from Nvidia, Bloomberg News reported on Wednesday, citing people familiar with the matter. Arm's licensing operation would fit poorly with Apple's hardware and software focused business model and there may also be regulatory concerns about Apple owning a key licensee that supplies so many rivals, according to the report. Nvidia and SoftBank did not immediately respond to requests for comment, while Arm declined to comment on the report.

• Sasol Ltd (SSL). The South African fuel producer said a unit damaged by fire at its Lake Charles Chemical Project (LCCP) should reach meaningful output by October, a month later than previous guidance. Six downstream chemical units at the 1.5 million ton per year ethane cracker feed into each other, and can only produce commercially viable output once a meaningful level of production is achieved. Shares in Sasol fell 2.43% as dampened global fuel demand, concerns about the LCCP project and lower than expect output weighed.

• Southwest Airlines Co (LUV). The company said on Wednesday it was eliminating all exemptions from its face-covering requirement except for children under 2 years old, in the toughest policy yet among U.S. airlines. Passengers can remove their coverings to eat, drink or take medicine, but Southwest said it expects those instances "to be very brief." Southwest also said it is rolling out a thermal screening trial at its homebase airport, Dallas Love Field, to respond to the pandemic.

• Tesla Inc (TSLA). The company's chief executive Elon Musk urged miners to produce more nickel, a key ingredient in the batteries that power the company's electric cars, warning the current cost of batteries remained a big hurdle to the company's growth. "Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way," Musk said on a post-earnings call on Wednesday. traders and analysts say the kinds of volumes Tesla would need are unlikely to make a compelling business case for most miners to invest in increased production, nor are they likely to boost prices. Separately, the carmaker said it will build its $1.1 billion Cybertruck factory near Austin, Texas, ending an intense competition with neighboring Oklahoma, Elon Musk announced late on Wednesday.

• Twitter Inc (TWTR). The company said on Wednesday that the hackers who breached its systems last week likely read the direct messages of 36 accounts, including one belonging to an elected official in the Netherlands. Asked by Reuters if the 36 accounts where messages might have been read included any verified accounts, Twitter said it would not answer. In general, someone with the ability to tweet from an account would also be able to read previously sent or received messages that had not been deleted. For accounts they won access to, the company said the hackers would have been able to see phone numbers and email addresses but not previous passwords.

• Westpac Banking Corp (WBK). The Australian lender tapped Deutsche Bank's chief of Australia and New Zealand as its institutional business head, as the lender rebuilds its top management team following a money-laundering scandal. Anthony Miller, who has led Deutsche Bank's Australia and New Zealand operations since 2017, will start in his new role later this year, Westpac said in a statement. At Westpac, Miller replaces Lyn Cobley, who left the company in May along with other top executives amid accusations that Westpac had enabled 23 million payments in breach of anti-money laundering laws.

ANALYSIS

U.S. sets global benchmark for COVID-19 vaccine price at around the cost of a flu shot

The U.S. government has set a benchmark for COVID-19 vaccine pricing in a $2 billion deal announced on Wednesday with Pfizer and German biotech BioNTech that will likely pressure other manufacturers to set similar prices, industry analysts told Reuters.

ANALYSTS' RECOMMENDATION

• Baker Hughes Co (BKR). Atb Capital raises target price to $23.50 from $22.75, after the company's second-quarter results beat consensus EBITDA by 17%.

• Biogen Inc (BIIB). RBC raises target price to $284 from $276, reflecting on the company's commercial franchises continuing to perform solidly despite COVID-19.

• Chipotle Mexican Grill Inc (CMG). RBC raises target price to $1,250 from $1,125, citing improved comparable sales and restaurant margin.

• Take-Two Interactive Software Inc (TTWO). Keybanc raises target price to $172 from $160, seeing positive trends for video game publishers since COVID-19 began.

• Tesla Inc (TSLA). Piper Sandler raises target price to $2,400 from $2,322, saying the company is likely to exceed 500,000 deliveries in 2020, despite being forced by COVID-19 to shutter its main factory for nearly half of the second quarter.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 Initial jobless claims: Expected 1,300,000; Prior 1,300,000

0830 Jobless claims 4-week average: Prior 1,375,000

0830 Continued jobless claims: Expected 17.067 mln; Prior 17.338 mln

COMPANIES REPORTING RESULTS

Cintas Corp (CTAS). Expected Q4 earnings of $1.21 per share

E*Trade Financial Corp (ETFC). Expected Q2 earnings of 76 cents per share

Edwards Lifesciences Corp (EW). Expected Q2 earnings of 17 cents per share

FirstEnergy Corp (FE). Expected Q2 earnings of 54 cents per share

Freeport-McMoRan Inc (FCX). Expected Q2 loss of 2 cents per share

Huntington Bancshares Inc (HBAN). Expected Q2 earnings of 4 cents per share

Intel Corp (INTC). Expected Q2 earnings of $1.11 per share

Kimberly-Clark Corp (KMB). Expected Q2 earnings of $1.80 per share

Nucor Corp (NUE). Expected Q2 earnings of 14 cents per share

People's United Financial Inc (PBCT). Expected Q2 earnings of 22 cents per share

Robert Half International Inc (RHI). Expected Q2 earnings of 37 cents per share

Skyworks Solutions Inc (SWKS). Expected Q3 earnings of $1.12 per share

SVB Financial Group (SIVB). Expected Q2 earnings of $3.11 per share

Tractor Supply Co (TSCO). Expected Q2 earnings of $2.52 per share

Union Pacific Corp (UNP). Expected Q2 earnings of $1.55 per share

Verisign Inc (VRSN). Expected Q2 earnings of $1.32 per share

W W Grainger Inc (GWW). Expected Q2 earnings of $3.39 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Danaher Corp (DHR). Q2 earnings conference call

0800 Discover Financial Services (DFS). Q2 earnings conference call

0800 Dow Inc (DOW). Q2 earnings conference call

0800 Landstar System Inc (LSTR). Q2 earnings conference call

0800 Twitter Inc (TWTR). Q2 earnings conference call

0800 Whirlpool Corp (WHR). Q2 earnings conference call

0815 Citrix Systems Inc (CTXS). Q2 earnings conference call

0830 American Airlines Group Inc (AAL). Q2 earnings conference call

0830 AT&T Inc (T). Q2 earnings conference call

0830 Corelogic Inc (CLGX). Q2 earnings conference call

0830 Equifax Inc (EFX). Q2 earnings conference call

0830 Pultegroup Inc (PHM). Q2 earnings conference call

0830 Quest Diagnostics Inc (DGX). Q2 earnings conference call

0845 Union Pacific Corp (UNP). Q2 earnings conference call

0900 Blackstone Group Inc (BX). Q2 earnings conference call

0900 Entegris Inc (ENTG). Q2 earnings conference call

0900 EQT Corp (EQT). Annual Shareholders Meeting

0900 Fifth Third Bancorp (FITB). Q2 earnings conference call

0900 Huntington Bancshares Inc (HBAN). Q2 earnings conference call

0900 Travelers Companies Inc (TRV). Q2 earnings conference call

0900 West Pharmaceutical Services Inc (WST). Q2 earnings conference call

1000 Advanced Drainage Systems Inc (WMS). Annual Shareholders Meeting

1000 Air Products and Chemicals Inc (APD). Q3 earnings conference call

1000 Cintas Corp (CTAS). Q4 earnings conference call

1000 Freeport-McMoRan Inc (FCX). Q2 earnings conference call

1000 Kimberly-Clark Corp (KMB). Q2 earnings conference call

1000 Rexnord Corp (RXN). Annual Shareholders Meeting

1000 Tractor Supply Co (TSCO). Q2 earnings conference call

1000 Watsco Inc (WSO). Q2 earnings conference call

1100 Exact Sciences Corp (EXAS). Annual Shareholders Meeting

1100 First American Financial Corp (FAF). Q2 earnings conference call

1100 Globe Life Inc (GL). Q2 earnings conference call

1100 Graco Inc (GGG). Q2 earnings conference call

1100 Hilltop Holdings Inc (HTH). Annual Shareholders Meeting

1100 M&T Bank Corp (MTB). Q2 earnings conference call

1100 Pool Corp (POOL). Q2 earnings conference call

1100 Reliance Steel & Aluminum Co (RS). Q2 earnings conference call

1100 Sun Communities Inc (SUI). Q2 earnings conference call

1100 W W Grainger Inc (GWW). Q2 earnings conference call

1130 East West Bancorp Inc (EWBC). Q2 earnings conference call

1230 Southwest Airlines Co (LUV). Q2 earnings conference call

1400 Nucor Corp (NUE). Q2 earnings conference call

1500 Old Republic International Corp (ORI). Q2 earnings conference call

1630 Manhattan Associates Inc (MANH). Q2 earnings conference call

1630 Skechers USA Inc (SKX). Q2 earnings conference call

1630 Skyworks Solutions Inc (SWKS). Q3 earnings conference call

1630 Verisign Inc (VRSN). Q2 earnings conference call

1700 Boston Beer Company Inc (SAM). Q2 earnings conference call

1700 Edwards Lifesciences Corp (EW). Q2 earnings conference call

1700 Intel Corp (INTC). Q2 earnings conference call

1700 People's United Financial Inc (PBCT). Q2 earnings conference call

1700 Robert Half International Inc (RHI). Q2 earnings conference call

1800 SVB Financial Group (SIVB). Q2 earnings conference call

EXDIVIDENDS

Jacobs Engineering Group Inc (J). Amount $0.19

Procter & Gamble Co (PG). Amount $0.79

Williams-Sonoma Inc (WSM). Amount $0.48

Prosus en AEX, Apple en Dow

Vandaag neem ik een index en een aandeel uit die index onder de loep. Over de oceaan kijk ik naar de Dow Jones en Apple. Hier in ons eigen kleine landje kijk ik naar de AEX en Prosus. Ik stel voor dat we direct van wal steken.Met de eerste grafiek is de reis kort, want ik begin met de…

Lees verder »Wake-up call: Beurs blijft switchen, Dow hoger en de Nasdaq twijfelt

Goedemorgen

We zien kleine plussen via de futures vanmorgen, de Nasdaq verloor wel na de cijfers van Microsoft maar aan de andere kant werd Tesla juist beloont omdat ze met winst kwamen nabeurs. Microsoft verloor 5 dollar na de cijfers maar Tesla steeg tot 4% nabeurs nadat de autofabrikant een aangepaste winst rapporteerde waardoor het bedrijf zo koers zet richting de SP 500-index hetgeen veel beleggers verrast want Tesla werd het grootste deel van het kwartaal behoorlijk geteisterd door de COVID-19 gerelateerde onderbrekingen. Het bedrijf wist 50 cent per aandeel te verdienen, in tegenstelling tot een verlies van 2,31 dollar per aandeel vorig jaar. Vooral de gecorrigeerde cijfers die eenmalig werden meegenomen zorgen dus voor winst, de omzet daalde wel met 5%. Zo krijg je natuurlijk iets recht wat krom moest zijn maar goed, we zijn het gewend. Wat Tesla nu op 1650 dollar doet blijft voor mij een raadsel maar het is wel zo. De waardering van Tesla blijft extreem hoog ...

Zo dat waren de belangrijkste cijfers van gisteren nabeurs, vanmorgen zie ik nog niet veel uitschieters, Europa vlak tot iets hoger, Azië vanmorgen gemiddeld bekeken wat lager maar de verschillen zijn minimaal. De VIX komt wel wat verder terug maar blijft aan de hoge kant waardoor blijkt dat we nog niet van de volatiele markt af geraken. Wat opvalt is dat de negatieve dagen achterblijven, ze zijn er wel maar dan vanaf een hoogtepunt op dagbasis naar vlak of iets lager. Dat hebben we nu bij de Nasdaq al 2 keer duidelijk gezien, de dalingen kwamen vanaf een hoge dagtop.

De sector rotatie blijft ook gaande, van traditioneel naar technolgie, dan naar de Transport en de pharma en weer andersom, sector rotatie zie je vaak aan het einde van een BULL beweging en we zitten er dus duidelijk in sinds midden maart. Nu komt de technologie wat omlaag, de traditionele bedrijven meestal uit de Dow Jones trekken de kar daar en de Transport is ook opnieuw wat aan het inleveren ten opzichte van vorige week toen de top werd gezet ... Nu nog allemaal op een rustige en naar mijn mening met een vreemd aanvoelende kalmte slepen de markten zich doorheen deze fase. Wel voel ik aan dat er een grotere move aan zit te komen, zeker door dat we zien dat beleggers aan het hoppen zijn van het ene naar het andere ofwel dat ze het niet weten.

We zitten in de markt nog steeds met wat kleine posities, zoals altijd wil ik mijn tijd nemen voor we uitstappen. De stops liggen ver genoeg, de doelen wat lager dan waar we nu staan. Lid worden kan tot 1 OKTOBER voor €39, dan ontvangt u de signalen, de updates en de coaching. De komende weken verwacht ik wel weer meer duidelijkheid over de richting. Schrijf u in via https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

The United States gave China 72 hours to close its consulate in Houston amid accusations of spying, marking a dramatic deterioration in relations between the world's two biggest economies.

Tesla posted a second-quarter profit as cost cuts and strong deliveries helped offset coronavirus-related factory shutdowns, sending its stock up in after-hours trading and clearing a hurdle that could lead to the electric carmaker's inclusion in the S&P 500 index.

South Korea plunged into recession in the second quarter in its worst economic decline in more than decades as the coronavirus pandemic battered exports and social distancing curbs paralysed factories.

EUROPEAN COMPANY NEWS

The U.S. government will pay nearly $2 billion to buy enough of a COVID-19 vaccine being developed by Pfizerand German biotech BioNTech to innoculate 50 million people if it proves to be safe and effective, the companies said on Wednesday.

Swiss construction chemicals maker Sika posted lower first-half sales and profit as the coronavirus pandemic stalled many building projects and industrial output slowed.

French video game maker Ubisoft said it was bringing in "profound changes" following allegations of inappropriate behaviour at the group, as it reported higher-than-forecast net bookings for its fiscal first quarter.

TODAY'S COMPANY ANNOUNCEMENTS

Adomos SA Annual Shareholders Meeting

ADVA Optical Networking SE Q2 2020 Earnings Call

Aixtron SE HY 2020 Earnings Call

Alimak Group AB (publ) Q2 2020 Earnings Call

Allegion PLC Q2 2020 Earnings Call

Also Holding AG HY 2020 Earnings Release

Amadeus Fire AG Q2 2020 Earnings Release

Ardagh Group SA Q2 2020 Earnings Release

Attendo AB (publ) Q2 2020 Earnings Release

Aurea SA Annual Shareholders Meeting

Aves One AG Annual Shareholders Meeting

Bankinter SA Q2 2020 Earnings Call

BHG Group AB Q2 2020 Earnings Call

Bodycote PLC HY 2020 Earnings Call

C&C Group PLC Annual Shareholders Meeting

Cembra Money Bank AG HY 2020 Earnings Call

Circassia Group PLC Annual Shareholders Meeting

Clontarf Energy PLC Annual Shareholders Meeting

Cnova NV HY 2020 Earnings Call

Compagnie des Eaux de Royan SA Annual Shareholders Meeting

Compagnie Plastic Omnium SE HY 2020 Earnings Call

Concentric AB Q2 2020 Earnings Release

Core Laboratories NV Q2 2020 Earnings Call

Covestro AG Q2 2020 Earnings Call

Daimler AG Q2 2020 Earnings Call

Dassault Aviation SA HY 2020 Earnings Release

Dassault Systemes SE HY 2020 Earnings Call

Edinburgh Investment Trust PLC Annual Shareholders Meeting

Eltel AB Q2 2020 Earnings Release

Epiroc AB Q2 2020 Earnings Call

Fidelity China Special Situations PLC Annual Shareholders Meeting

G4S PLC HY 2020 Earnings Call

Gaussin SA Annual Shareholders Meeting

Gecina SA HY 2020 Earnings Release

Getech Group PLC Annual Shareholders Meeting

Hoist Finance AB (publ) Q2 2020 Earnings Release

Howden Joinery Group PLC HY 2020 Earnings Call

Huhtamaki Oyj Q2 2020 Earnings Call

ICON PLC Q2 2020 Earnings Call

Idorsia Ltd HY 2020 Earnings Call

IG Group Holdings PLC FY 2020 Earnings Release

Immunodiagnostic Systems Holdings PLC Annual Shareholders Meeting

Intrum AB Q2 2020 Earnings Call

Ipsos SA HY 2020 Earnings Call

Johnson Matthey PLC Annual Shareholders Meeting

Kesko Oyj Q2 2020 Earnings Release

Kulmbacher Brauerei AG Annual Shareholders Meeting

Leonteq AG HY 2020 Earnings Call

Lisi SA HY 2020 Earnings Release

Live Company Group PLC Annual Shareholders Meeting

Marel hf Q2 2020 Earnings Call

Martin Currie Global Portfolio Trust PLC Annual Shareholders Meeting

McKay Securities PLC Annual Shareholders Meeting

Mincon Group PLC Annual Shareholders Meeting

MIPS AB Q2 2020 Earnings Call

Modern Times Group MTG AB Q2 2020 Earnings Call

Neste Oyj Q2 2020 Earnings Release

NORDWEST Handel AG Annual Shareholders Meeting

NOS SGPS SA Q2 2020 Earnings Call

Ossur hf Q2 2020 Earnings Call

Pentair PLC Q2 2020 Earnings Call

Petards Group PLC Annual Shareholders Meeting

PGS ASA Q2 2020 Earnings Release

Publicis Groupe SA HY 2020 Earnings Call

REC Silicon ASA Q2 2020 Earnings Call

Red Rock Resources PLC Shareholders Meeting

Relx PLC HY 2020 Earnings Call

Remy Cointreau SA Annual Shareholders Meeting

Repsol SA Q2 2020 Earnings Call

Roche Holding AG HY 2020 Earnings Call

Scor SE HY 2020 Earnings Call

SEB SA HY 2020 Earnings Call

Seven Principles AG Annual Shareholders Meeting

Sika AG HY 2020 Earnings Call

Skanska AB Q2 2020 Earnings Call

Sligro Food Group NV HY 2020 Earnings Call

Societe de la Tour Eiffel SA HY 2020 Earnings Release

Spir Communication SA HY 2020 Earnings Release

STMicroelectronics NV Q2 2020 Earnings Call

Tate & Lyle PLC Annual Shareholders Meeting

Telecom Plus PLC Annual Shareholders Meeting

TGS NOPEC Geophysical Company ASA Q2 2020 Earnings Call

Triple Point Income VCT PLC Annual Shareholders Meeting

Unilever NV HY 2020 Earnings Release

Unilever PLC HY 2020 Earnings Release

UPM-Kymmene Oyj Q2 2020 Earnings Release

ValiRx PLC Annual Shareholders Meeting

Valmet Oyj Q2 2020 Earnings Release

Visibilia Editore SpA Annual Shareholders Meeting

VP PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 Germany GfK Consumer Sentiment for Aug: Expected -5.0; Prior -9.6

0645 France Business Climate Manufacturing for Jul: Prior 85 77

0730 Sweden Unemployment Rate for Jun: Prior 9.0%

0730 Sweden Unemployment Rate SA for Jun: Expected 8.6%; Prior 8.5%

0730 Sweden Total Employment for Jun: Prior 5.023 mln

1000 United Kingdom CBI Business Optimism for Q3: Prior -87

1000 United Kingdom CBI Trends - Orders for Jul: Expected -38; Prior -58

1200 United Kingdom Steel Production for Jun: Prior 700,000

1400 Euro Zone Consumer Confidence Flash for Jul: Expected -12.0; Prior -14.7

2301 United Kingdom GfK Consumer Confidence for Jul: Expected -26; Prior -30

blog! We waren zo enthousiast hierover en jij volgens mij ook.