Liveblog Archief maandag 7 juni 2021

Markt snapshot Wall Street 7 juni

TOP NEWS

• Tech giants and tax havens targeted by historic G7 deal

The United States, Britain and other large, rich nations reached a landmark deal on Saturday to squeeze more money out of multinational companies such as Amazon and Google and reduce their incentive to shift profits to low-tax offshore havens.

• From lapsing job benefits to full stadiums, June could be U.S. recovery's pivot

Fourteen months after the pandemic triggered a national emergency, the final chapter of the U.S. economic recovery may begin this month, with rapid changes starting with the end of enhanced unemployment benefits in half the states and ending in the fall's expected reopening of schools and universities.

• Some on Wall Street try options trade to bet against AMC without getting burned

Some Wall Street traders are betting against another massive rally in AMC Entertainment Holdings and other "meme" stocks this week through a type of wager in the options market that would limit their losses should retail investors behind the run-up prove them wrong.

• Google agrees to alter ad practices after France imposes fine

Alphabet's Google agreed to make changes to some of its widely-used online advertising services under an unprecedented settlement with France's antitrust watchdog released.

• U.S. FDA set to rule on controversial Biogen Alzheimer's drug

The U.S. FDA is expected to give its thumbs up or down on Biogen’s aducanumab, a decision that will affect the future of Alzheimer's disease research and treatment and show the agency's willingness to approve badly needed medicines based on less than definitive data.

BEFORE THE BELL

U.S. stock index futures fell as investors remained on the fence ahead of key inflation data later this week, while heavyweight technology shares largely shrugged off a deal by the world's richest nations on a global minimum corporate tax. European stocks were in the green as losses in commodity-linked shares sparked by downbeat China export data more than offset another run of gains in automakers. Japanese shares closed higher. The dollar gained, while gold prices slipped. Oil prices fell, pressured by the prospect of higher Iranian exports.

STOCKS TO WATCH

Deals Of The Day

• Blackstone Group Inc & Carlyle Group: A consortium of three private equity firms, including Blackstone and Carlyle, have signed a definitive agreement to buy a majority stake in medical supplier Medline Industries Inc, sources familiar with the matter have told Reuters. The deal values Medline at more than $30 billion, excluding debt, the sources said. Medline has an enterprise value of about $34 billion, including borrowings, the sources said. Medline's current management and founding family, led by Chief Executive Charles Mills, will remain the company's largest single shareholder when the deal is expected to close in the second half of this year, the sources said.

• Bonanza Creek Energy Inc & Extraction Oil & Gas Inc: Civitas Resources Inc, the U.S. oil and gas producer being formed through the merger of Bonanza Creek Energy and Extraction Oil & Gas, will acquire peer Crestone Peak Resources for $1.3 billion, including debt, according to people familiar with the matter. Civitas will use its own stock as currency to pay Crestone's owners, including the Canada Pension Plan Investment Board (CPPIB) and investment firm The Broe Group, the sources said. The agreement could be announced as early as Monday, they added. The sources spoke on condition of anonymity ahead of a formal announcement. Bonanza Creek, Extraction and Crestone did not immediately respond to requests for comment.

In Other News

• Alphabet Inc: Google agreed to make changes to some of its widely-used online advertising services under an unprecedented settlement with France's antitrust watchdog released. The authority also fined the company $267.48 million after a probe found it abused its market power in the intricate ad business online, where some of its tools have become almost essential for large publishers. "The decision to sanction Google is of particular significance because it's the first decision in the world focusing on the complex algorithmic auction processes on which the online ad business relies," said France's antitrust chief Isabelle de Silva. Under the terms of the settlement, Google offered commitments to improve the interoperability of Google Ad Manager services with third-party ad server and ad space sales platform, the watchdog said.

• Amazon.com Inc, Alphabet Inc & Facebook Inc: The United States, Britain and other large, rich nations reached a landmark deal on Saturday to squeeze more money out of multinational companies such as Amazon and Google and reduce their incentive to shift profits to low-tax offshore havens. Hundreds of billions of dollars could flow into the coffers of governments left cash-strapped by the COVID-19 pandemic after the Group of Seven (G7) advanced economies agreed to back a minimum global corporate tax rate of at least 15%. Facebook said it expected it would have to pay more tax, in more countries, as a result of the deal, which comes after eight years of talks that gained fresh impetus in recent months after proposals from U.S. President Joe Biden's new administration.

• AMC Entertainment Holdings Inc: Some Wall Street traders are betting against another massive rally in AMC and other "meme" stocks this week through a type of wager in the options market that would limit their losses should retail investors behind the run-up prove them wrong. A Reuters analysis of options data and interviews with market participants, including a Wall Street banker and a fund manager with $30 billion in assets, show that some institutional investors have ramped up complex options trades that let them bet the shares will fall. The so-called “bear put spread,” a common bearish options strategy, also limits profits.

• Apollo Global Management Inc: Acropolis Infrastructure Acquisition, a blank-check firm backed by an affiliate of Apollo Global, is looking to raise $400 million through a U.S. initial public offering, according to a regulatory filing. The special purpose acquisition company (SPAC) plans to sell 40 million units, composed of shares and warrants, priced at $10 per unit.

• AstraZeneca PLC & Johnson & Johnson: The European Medicines Agency (EMA) pushed guidance for doctors not to use the blood thinner heparin to treat rare blood clots and low blood platelets in people who got AstraZeneca's or Johnson & Johnson's COVID-19 shots. Europe's drugs regulator, seeking to ensure proper treatment, highlighted the International Society on Thrombosis and Haemostasis (ISTH) interim guidance. In April, the ISTH concluded "management should be initiated with non-heparin anticoagulation upon suspicion" of vaccine-linked clotting and low platelets. Alternative anti-coagulants include fondaparinux or argatroban.

• Autodesk Inc: Australian-listed software maker Altium rejected a $3.9 billion takeover bid from its U.S. peer as too low, but kept the door open for a higher offer as its shares leapt. Autodesk offered Altium A$38.50 for each share, a 41% premium to its last closing price, valuing the company at A$5.05 billion. Altium rejected the approach "at the current price" which analysts said valued it at 17 times forecast 2022 sales or 44 times forecast earnings. It added that it would engage with interested parties for an appropriate valuation and pursue a "review of all potential strategic alternatives".

• Biogen Inc: The U.S. FDA on Monday is expected to give its thumbs up or down on the company’s aducanumab, a decision that will affect the future of Alzheimer's disease research and treatment and show the agency's willingness to approve badly needed medicines based on less than definitive data. Aducanumab has been at the center of a divisive public battle. The Food and Drug Administration is under enormous pressure from patient advocacy groups and some doctors to approve the first major drug for the mind-wasting condition, while many experts say huge amounts of money will be spent despite a lack of compelling evidence aducanumab can provide meaningful benefit. Approval could reinvigorate a failure-laden field that has been abandoned by many large drugmakers and give Biogen a new multibillion-dollar seller.

• Macquarie Infrastructure Corp & KKR & Co Inc: Macquarie is close to selling its Atlantic Aviation private aviation services network to KKR for around $4.5 billion, a source familiar with the matter said, as U.S. business jet flights surge. A deal for Atlantic, the second-largest fixed-base operator network, has not yet been signed, the source said. Macquarie Infrastructure and KKR both declined comment on Sunday.

• Microsoft Corp & Nuance Communications Inc: The company has won U.S. antitrust approval for its deal to buy artificial intelligence and speech technology company Nuance Communications, according to a filing made by Nuance to the government. The $16 billion deal, which was announced in April, came after the companies partnered in 2019 to automate healthcare administrative work, such as documentation. Nuance said in a filing to the U.S. Securities and Exchange Commission on Friday that the deadline for the U.S. government to object to the deal had expired on June 1. That expiration "satisfies one of the conditions to the closing of the merger," the company said in the filing. A spokesperson for Microsoft said that the deal was undergoing regulatory reviews in other jurisdictions and was intended to close at the end of 2021.

• New York Times Co: The Department of Justice said on Saturday that it would no longer seek source information from reporters in leak investigations after recent revelations that former President Donald Trump's administration had secretly obtained phone and email records from a number of journalists. CNN and the Washington Post have said the Trump administration had secretly tried to obtain the phone records of some of their reporters over work they did in 2017. The New York Times reported that the Justice Department under presidents Trump and Joe Biden waged "a secret legal battle to obtain the email logs of four New York Times reporters," and imposed a gag order on executives.

• Twitter Inc: India has told the company it has one last chance to comply with new IT rules, or face "unintended consequences" according to a copy of an official letter seen by Reuters. The new rules - which were announced in February and which became effective at the end of last month - are aimed at regulating content on social media and making firms such as Facebook, its WhatsApp messenger and Twitter more accountable to legal requests. They also require big social media companies to set up grievance redressal mechanisms and appoint new executives to coordinate with law enforcement.

• Sinovac Biotech Ltd: China has approved emergency use of the company’s COVID-19 vaccine in people aged between three and 17, its chairman Yin Weidong told state TV late on Friday. When Sinovac's vaccine will be offered to younger groups depends on health authorities formulating China's inoculation strategies, Yin told state TV in an live interview. Preliminary results from Phase I and II clinical trials showed the vaccine could trigger immune response in three to 17 year-old participants, and most adverse reactions were mild.

• Rio Tinto PLC: An Aboriginal group on whose lands the company mines iron ore in Western Australia said it did not support the miner's board appointment of former state minister Ben Wyatt, citing his approvals that led to destruction of cultural heritage sites. "Unfortunately, our engagement with Mr Wyatt has not been positive and we do not see him helping to restore Rio’s reputation with indigenous stakeholders," said Glen Camile, chairman of the firm that holds native title to the lands. The firm's view was largely based on Wyatt's consistent approval of applications to destroy Aboriginal heritage sites in the state's development process, it said in a statement late on Friday.

• Tesla Inc: Production for the company’s longest-range Model S Plaid+ is canceled, CEO Elon Musk said in a tweet on Sunday. "Plaid+ is canceled. No need, as Plaid is just so good." Musk tweeted. Model S Plaid+, which would have been Tesla's highest-end model with a driving range of 520 miles, was unveiled at a battery event last year and Musk said it would adopt its next generation 4680 battery cells. But production was pushed back to 2022 from the end of 2021. Musk on Sunday called the Model S Plaid the "quickest production car ever made of any kind."

• Walmart Inc: Indian e-commerce firm Flipkart is in talks to raise at least $3 billion from investors including SoftBank Group and several sovereign wealth funds, Bloomberg News reported. The startup is aiming for a valuation of about $40 billion and is in talks with Singapore's GIC Pte., Canada Pension Plan Investment Board and the Abu Dhabi Investment Authority, the report said, citing people familiar with the matter. SoftBank could invest $300 million to $500 million of the total through its Vision Fund II, according to the report.

ANALYSIS

Market for U.S. oil acreage booms along with crude price recovery

A recovery in the price of oil to more than two-year highs is offering a long-awaited opening to companies and private equity firms to shed unloved assets in the U.S. oil patch.

ANALYSTS' RECOMMENDATION

• Criteo SA: D.A. Davidson raises target price to $46 from $29, reflecting on the company’s Commerce Media Platform strategy success and increased guidance for 2021.

• Globe Life Inc: Credit Suisse raises target price to $135 from $122, citing strong growth prospects and share repurchases.

• PCB Bancorp: Piper Sandler raises target price to $21 from $19, citing acceleration in growth prospects and improved credit outlook.

• Medallia Inc: Berenberg cuts target price to $33 from $34, citing share trade below historical average and expecting operating margins to decline in FY2022.

• Visa Inc: Piper Sandler raises target price to $260 from $234, reflecting on post-pandemic economic recovery in the U.S..

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 (approx.) Employment trends for May: Prior 105.40

1500 Consumer credit for Apr: Expected 21.00 bln; Prior 25.84 bln

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0830 G-III Apparel Group Ltd: Q1 earnings conference call

0900 Acushnet Holdings Corp: Annual Shareholders Meeting

0900 Safehold Inc: Annual Shareholders Meeting

0900 Watsco Inc: Annual Shareholders Meeting

1000 Lovesac Co: Annual Shareholders Meeting

1100 Buckle Inc: Annual Shareholders Meeting

1100 UnitedHealth Group Inc: Annual Shareholders Meeting

1200 Kodiak Sciences Inc: Annual Shareholders Meeting

1200 Systemax Inc: Annual Shareholders Meeting

1300 Array Technologies Inc: Annual Shareholders Meeting

1300 ServiceNow Inc: Annual Shareholders Meeting

1300 Veracyte Inc: Annual Shareholders Meeting

1400 Grocery Outlet Holding Corp: Annual Shareholders Meeting

1500 Ares Capital Corp: Annual Shareholders Meeting

1600 AssetMark Financial Holdings Inc: Annual Shareholders Meeting

1630 Coupa Software Inc: Q1 earnings conference call

1630 Healthequity Inc: Q1 earnings conference call

1645 Marvell Technology Inc: Q1 earnings conference call

1700 Duckhorn Portfolio Inc: Q3 earnings conference call

1700 Stitch Fix Inc: Q3 earnings conference call

1700 Vail Resorts Inc: Q3 earnings conference call

1900 Invitae Corp: Annual Shareholders Meeting

2100 Dada Nexus Ltd: Q1 earnings conference call

EX-DIVIDENDS

Air Lease Corp: Amount $0.16

American Financial Group Inc: Amount $14.0

Bentley Systems Inc: Amount $0.03

Brown-Forman Corp: Amount $0.17

Cigna Corp: Amount $1.00

First American Financial Corp: Amount $0.46

Kontoor Brands Inc: Amount $0.40

Public Service Enterprise Group Inc: Amount $0.51

Ross Stores Inc: Amount $0.28

Stanley Black & Decker Inc: Amount $0.70

Texas Pacific Land Corp: Amount $2.75

TFS Financial Corp: Amount $0.28

UniFirst Corp: Amount $0.25

Start nieuwe week met twijfels, winstnemingen op komst?

Goedemorgen,

We zien voorbeurs lagere futures zodat we de eerste dag van de week lager kunnen starten. Ik zal in de loop van de dag inschatten wat er kan worden gedaan wat betreft nieuwe posities, gisteren heb ik dat al aan de leden doorgegeven via een update. Het is wachten op de echte reactie van de markt op wat men de afgelopen week te weten kwam wat betreft de economische cijfers. Veel indices staan op, boven of nog net iets onder hun hoogste stand ooit momenteel, normaal gezien zouden winstnemingen in deze zone snel op gang kunnen komen want de waardering van aandelen staat te hoog. De SP 500 komt nu gemiddeld al uit op 45 keer de winst.

De S&P 500 won vrijdag 0,9% met een slot op 4.230 punten, op weekbasis sluit deze index 0,6% hoger. De Dow Jones won vrijdag 0,5% met een slot op 34.756 punten, op weekbasis zien we een winst van 0,65%. Kijken we naar de Nasdaq dan zien we vrijdag een plus van 1,5% met een slot op 13.814 punten, over de gehele week won de Nasdaq 0,5%. Verder zien we de Nasdaq 100 vrijdag 1,8% hoger sluiten met een weekwinst van 0,6%, de SOX index won vrijdag 2,4% en op weekbasis een winst van 0,9%. De Dow Transport deed het dan in tegenstelling niet zo best, we zien een verlies van -0,5% vrijdag en op weekbasis verloor deze index zelfs -1,8%.

Wat betreft Europa dan bij de 3 indices die we volgen een nieuw recordslot, de AEX sluit vrijdag 0,4% hoger, op weekbasis wint onze index 1% hoger. De DAX zet ook een nieuw record neer vrijdag, de index won 0,4%. Op weekbasis won de DAX 1,1%. De Franse CAC 40 sloot vrijdag 0,1% in de plus, over de gehele week bekeken zien we daar een plus van 0,5% en ook een nieuw recordslot daar.

Overal plussen zoals u ziet en in Europa een recordreeks die opvalt bij zowel de AEX, de DAX en de CAC 40 index. De afgelopen week verliep eigenlijk vrij stabiel op een terugval die donderdag op gang kwam na maar de DIP werd razendsnel weer opgekocht. Wel staan de indices nu behoorlijk hoog en dat zet de waarderingen op die manier weer een aantal stapjes hoger waardoor we vooral moeten opletten dat er niet teveel wordt betaalt voor bepaalde aandelen. Let wel, er zijn nog aandelen die achterblijven maar het zijn vooral de grote winnaars van de afgelopen tijd die er gevaarlijk bij liggen nu. De koers-winst verhoudingen lopen dus snel op.

Dan de sessie van vrijdag, die stond volledig in het teken van het Amerikaans banenrapport. Beleggers bedachten snel wat de gevolgen zouden zijn voor de markten maar al snel kwam men tot de conclusie dat de economische cijfers dan wel tegenvallen maar dat zoiets van invloed zal zijn op de discussie door de FED die gaat over het afbouwen van het soepele monetaire beleid de komende periode. Beleggers denken dus dat het niet zal gebeuren gezien de reactie van de markt. De werkgelegenheid steeg dus minder snel dan werd verwacht. Meerdere analisten gaven na de cijfers al aan dat de banengroei de komende tijd sterk zal blijven schommelen.

Wat betreft het handelen voor mezelf en dus voor de leden die mijn signalen ontvangen had ik al bepaald om niks te doen vrijdag, het is te onzeker om te handelen rondom deze cijfers als de markten al op een punt staan waar het beide kanten op kan. Vanaf begin volgende week kunnen we mogelijk weer een top neerzetten en dat moment lijkt me een beter punt om eventueel met wat kleine shorts in de markt te stappen. Er komt daar wel op tijd een bericht voor richting de leden.

Resultaat dit jaar verloopt nog altijd naar wens en we blijven rustig:

We hebben de short posities gesloten tijdens de daling donderdag omdat ik snel merkte dat de divergentie terug aan het keren was. Er werd winst behaald zodat de eerste resultaten voor de maand juni er nu staan. We doen rustig verder en ik zoek naar een nieuwe instap bij de indices. Eerst maar eens zien hoe de markten gaan reageren later vandaag op cijfers.

We staan er dit jaar in ieder geval al heel goed voor dus ik kan voorzichtig verder. Wordt nu dus lid en volg de signalen die er snel weer komen ... Zie hieronder het resultaat van deze maand per abonnement.

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 AUGUSTUS voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JUNI):

Technische ontwikkeling markt:

De situatie

Overzicht markt:

Technische conditie AEX:

De AEX kende na een twijfelende start toch een positief verloop richting het slot mede door de euforische reactie op Wall Street na de slechte cijfers. De AEX sluit voor de 2e keer tijdens de afgelopen week met een nieuw record, de nieuwe hoogste slotstand zien we nu op 720,18 punten uitkomen. Intraday wist de AEX al eens de 722,07 punten aan te tikken de afgelopen week wat dan meteen de hoogste stand ooit is voor de AEX index.

Weerstand na de uitbraak boven de 718-719 punten zien we nu rond de 722 punten (hoogste stand ooit) en de 725 punten, later de 732 en de 745 punten als weerstand na de uitbraak. Steun wordt nu eerst de 718 punten, later de 712 en de 708 punten waar nu ook het 50-daags gemiddelde wacht. De oplopende steunlijn zien we rond de 704-705 punten uitkomen nu.

De AEX wordt zeer interessant om te volgen nu, we kunnen er denk ik wat mee gaan doen de komende week want er zal hoe dan ook snel een reactie komen op de stijging van de afgelopen dagen. We gaan daar een signaal over sturen naar de leden zodra het momentum goed lijkt. Meedoen kan dus door lid te worden.

Technische conditie DAX:

De DAX blijft heel sterk liggen en zet weer een nieuw record neer op 15.693 punten, het is nu al voor de 3e dag op rij dat er een nieuw record staat en de 15.550 punten weerstand lijkt nu doorbroken. De volgende weerstand zien we rond de 16.050 punten waar de lijn over de toppen uitkomt. Ook Europa reageerde dus positief op de cijfers in de VS die slechter waren dan werd verwacht. Steun nu de 15.500 en de 15.250 punten, rond die 15.250 punten zien we de lijn onder de bodems uitkomen samen met het 50-daags gemiddelde en dat wordt nu een zeer belangrijke steun. Let erop dat alles er nu zeer rooskleurig uitziet maar dat de steun slechts 400 punten onder de huidige slotstand uitkomt.

De DAX wordt zeer interessant om te volgen nu, we kunnen er denk ik wat mee gaan doen de komende week want er zal hoe dan ook snel een reactie komen op de stijging van de afgelopen dagen. We gaan daar een signaal over sturen naar de leden zodra het momentum goed lijkt. Meedoen kan dus door lid te worden.

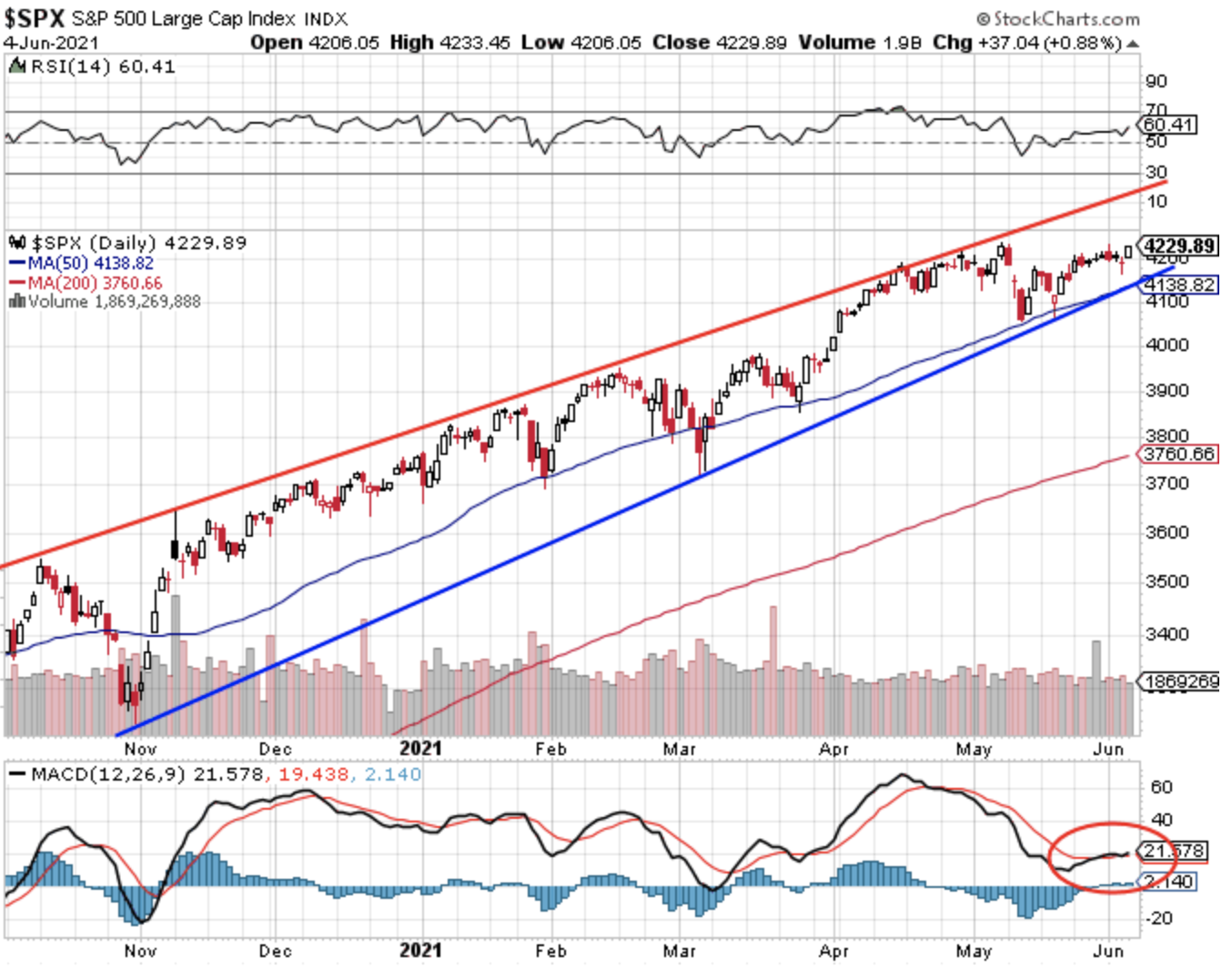

S&P 500 analyse:

De S&P 500 kruipt verder op richting de hoogste stand ooit, die zien we rond de 4238 punten uitkomen, het slot van vrijdag komt uit op 4230 punten dus een test van de top zit er zeker in de komende dagen. De lijn over de toppen komt nu uit rond de 4325 punten en kan bij een uitbraak wel eens het doel worden. We zijn er nog niet maar zoals u ziet naderen we snel, door de slechte cijfers van vrijdag ebt de vrees voor stijgende rente wat weg en zien beleggers dat de FED voorlopig niks zal doen. Dat is de gedachte van nu, het moet allemaal wel nog doorzetten.

Weerstand nu de top rond de 4238 punten, later de 4275 en de 4325 punten waar de lijn over de toppen uitkomt. Steun kunnen we verwachten rond de 4195-4200 punten, later de 4140 punten waar nu de lijn onder de bodems uitkomt samen met het 50-daags gemiddelde. Alles blijft binnen bereik en het kan snel gaan, dat weten we en daar moeten we altijd rekening mee houden in deze fase. De volatiliteit zal niet zo maar ophouden, de bewegingen zullen groot blijven mijn inziens.

Analyse Nasdaq:

De Nasdaq lag er vrijdag sterk bij mede door dat de vrees voor verder oplopende rente na de cijfers over de werkgelegenheid afnam, de cijfers vielen tegen. We zien meestal dat in dit soort situaties de Nasdaq daar het meest van profiteert en de index steeg met 200 punten vrijdag.

We zitten weer rond de top van de afgelopen week nu, boven de 13.750 en onderweg naar de 13.850 punten waar we de volgende weerstand zien uitkomen. Later wacht de topzone rond de 14.200 punten als weerstand, de komende week maar eens zien of de Nasdaq daar naartoe kan maar dan moet alles meezitten. Het 50-daags gemiddelde zien we nu rond de 13.655 punten, er komt daar ook nog een steunlijn uit zoals u kunt zien op de grafiek. De oplopende steunlijn zien we rond de 13.300-13.325 punten, deze lijn blijft belangrijk voor wat betreft de uptrend bij de Nasdaq.

Euro, olie en goud:

De euro zien we nu rond de 1.216 dollar, de prijs van een vat Brent olie komt uit op 71,4 dollar terwijl een troy ounce goud nu op 1890 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 AUGUSTUS voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Hieronder de resultaten van dit jaar (2021):

Met vriendelijke groet,

Guy Boscart

TA - Trendlijnen in de AEX

Arcelor Mittal Arcelor Mittal heeft de smaak te pakken en lijkt te profiteren van de groeiende vraag naar staal. Het aandeel staat bij 160% hoger dan precies 1 jaar geleden. Na een mislukte poging (januari 2021) om de weerstand op 21,50 EUR te doorbreken, viel de koers terug naar de steun…

Lees verder »Markt snapshot Europa 7 juni

MARKET VIEW

Financial spreadbetters expect London's FTSE to open 2 points lower at 7,067, Frankfurt's DAX to open 35 points lower at 15,658 and Paris' CAC to open 13 points lower at 6,503.

Japan's Nikkei share average inched higher after a U.S. jobs report eased concerns over early tapering from the Federal Reserve, but gains were limited by heavy profit-taking.

Oil pulled back after hitting fresh multi-year highs, as investors awaited the outcome of this week's talks between Iran and world powers over a nuclear deal that is expected to boost crude supplies.

MARKET SNAPSHOT AS OF 0425 GMT

S&P 500 Index Mini Futures: 4,223.50; down 0.11%; 4.75 points

DJIA Mini Futures: 34,725.00; down 0.05%; 17 points

Nikkei: 29,062.49; up 0.42%; 120.97 points

MSCI Asia, Ex-JP: 704.20; down 0.12%; 0.86 point

EUR/USD: $1.2170; up 0.02%; 0.0003 point

GBP/USD: $1.4147; down 0.07%; 0.0010 point

USD/JPY: 109.43 yen; down 0.07%; 0.07 point

Spot Gold: $1,885.96; down 0.21%; $4.01

U.S. Crude: $69.34; down 0.40%; $0.28

Brent Crude: $71.50; down 0.54%; $0.39

10-Yr U.S. Treasury Yield: 1.5696%; up 0.01 point

10-Yr Bund Yield: -0.2120%; down 0.001 point

GLOBAL TOP NEWS

The United States, Britain and other large, rich nations reached a landmark deal on Saturday to squeeze more money out of multinational companies such as Amazon and Google and reduce their incentive to shift profits to low-tax offshore havens.

Australia's anti-money-laundering agency said it was investigating casino operator Star Entertainment Group over suspected breaches of customer due diligence laws, jeopardising a A$9 billion proposal to buy rival Crown Resorts.

Democrats will start the process on Wednesday of preparing an infrastructure bill for a vote in the U.S. House of Representatives, with or without Republican support, U.S. Energy Secretary Jennifer Granholm told CNN on Sunday morning.

EUROPEAN COMPANY NEWS

Volkswagen on Sunday said it had reached the broad outlines of a settlement with former boss Martin Winterkorn over his role in the dieselgate scandal, with the final details to be thrashed out over coming days.

Airbus Chief Executive Guillaume Faury expects business air travel eventually to return to close to pre-pandemic levels and airlines are devoting the same space to business class seats as before, he said in an interview published on Sunday.

British consumer goods maker Reckitt Benckiser said on Saturday it was selling its infant formula and child nutrition business in China to investment firm Primavera Capital Group for an enterprise value of $2.2 billion.

TODAY'S COMPANY ANNOUNCEMENTS

AST Groupe SA Annual Shareholders Meeting

Intek Group SpA Shareholders Meeting

Ocean Outdoor Ltd Annual Shareholders Meeting

Redx Pharma PLC HY 2021 Earnings Call

S4 Capital PLC Annual Shareholders Meeting

Telesia SpA Annual Shareholders Meeting

Zaim Credit Systems PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0545 Switzerland Unemployment Rate Unadjusted for May: Prior 3.3%

0545 Switzerland Unemployment Rate Adjusted for May: Prior 3.1%

0600 (approx.) Germany Industrial Orders mm for Apr: Expected 1%; Prior 3%

0600 (approx.) Germany Manufacturing O/P Current Price SA for Apr: Prior 29.5%

0600 (approx.) Germany Consumer Goods SA for Apr: Prior 116.5

0630 Switzerland CPI mm for May: Expected 0.3%; Prior 0.2%

0630 Switzerland CPI yy for May: Expected 0.6%; Prior 0.3%

0630 (approx.) Switzerland CPI NSA for May: Prior 100.8

0645 (approx.) France Reserve Assets Total for May: Prior 183,428 mln EUR

0700 Spain Industrial Output Cal Adjusted yy for Apr: Prior 12.4%

0700 (approx.) Switzerland Forex Reserves for May: Prior 914,080 mln CHF

0700 (approx.) Austria Wholesale Prices NSA mm for May: Prior 0.6%

0700 (approx.) Austria Wholesale Prices NSA yy for May: Prior 8.7%

0730 (approx.) United Kingdom Halifax House Prices mm for May: Expected 1.2%; Prior 1.4%

0730 (approx.) United Kingdom Halifax House Prices yy for May: Expected 10%; Prior 8.20%

0830 (approx.) Euro Zone Sentix Index for Jun: Expected 26.0; Prior 21.0

1000 (approx.) United Kingdom BBA Mortgage Rate for May: Prior 3.61%

2301 United Kingdom BRC Retail Sales yy for May: Prior 39.6%