Liveblog Archief woensdag 7 juli 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: JOLTs Vacatures (May) | Actueel: 9,209M Verwacht: 9,388M Vorige: 9,193M |

Markt snapshot Wall Street 7 juli

TOP NEWS

• Pentagon hits reset on Trump's $10 billion cloud deal, welcoming new players

The U.S. Defense Department canceled its $10 billion JEDI cloud-computing project on Tuesday, reversing the Trump-era award to Microsoft and announcing a new contract expected to include its rival Amazon.com and possibly other cloud players.

• Shell to boost shareholder returns after oil price rise

Royal Dutch Shell will boost returns to shareholders via share buybacks or dividends earlier than expected after a sharp rise in oil and gas prices helped it reduce debt, the Anglo-Dutch energy firm said.

• Google-backed Planet Labs to go public in $2.8 billion SPAC deal

Earth data and analytics company Planet Labs, which is backed by Alphabet's Google, will go public through a merger with a blank-check company in a deal valued at $2.8 billion, the companies said.

• Chinese EV maker Xpeng shares close flat in HK debut as it eyes global rollout

Chinese electric vehicle maker Xpeng closed flat at its $1.8 billion Hong Kong dual primary listing as the company said it would develop future models based on product platforms designed for international markets.

• Bill Gates-backed Heliogen to go public through $2 billion SPAC deal

Solar power firm Heliogen will merge with a special-purpose acquisition company (SPAC) to go public in a deal that values the combined entity at about $2 billion, the companies said.

BEFORE THE BELL

The Nasdaq futures hit a record high as a fall in Treasury yields supported tech-heavy growth stocks, while investors focused on the Federal Reserve's minutes from the June meeting to gauge the trajectory of policy support going forward. European stocks gained as commodity-linked stocks recovered from sharp falls in the previous session. Japanese shares ended lower, dragged down by chip-related stocks, while China shares closed higher after Beijing stepped up supervision of Chinese firms listed overseas. The euro edged lower against the dollar after German data raised doubts about the strength of the economic recovery, while the U.S. currency was little changed against a basket of major currencies. Oil prices rose, recovering from a steep drop in the previous session and gold prices advanced.

STOCKS TO WATCH

IPOs

• Authentic Brands Group Inc: The company on Tuesday filed for a U.S. initial public offering following a year that saw the parent of apparel chain Aéropostale and Sports Illustrated magazine post strong earnings growth. Authentic Brands, which also owns the Forever 21 brand, plans to list its stock on the New York Stock Exchange under the symbol "AUTH", it said in a regulatory filing. The company's 2020 net income jumped to about $211 million from $72.5 million a year earlier, while its revenue rose nearly 2% to $488.9 million. The firm was targeting a valuation of about $10 billion in its IPO, CNBC reported in May, citing a person familiar with the matter.

Deals Of The Day

• Athene Holding Ltd & Apollo Global Management Inc: Retirement services provider Athene and private-equity firm Apollo acquired up to 18% of Australia's Challenger for $539.42 million, the companies said. The news sent shares of the Australia's largest provider of annuities soaring. The two American companies, which are set to merge in an $11 billion all-stock deal, bought 15% from existing shareholder Caledonia Investments, Challenger said. The remaining 3% is subject to approval from banking regulator Australian Prudential Regulation Authority. According to a regulatory filing by Challenger, the pair had started picking shares in the market from May 24 until July 5.

• Athena Technology Acquisition Corp: The Bill Gates-backed solar power firm Heliogen will merge with Athena to go public in a deal that values the combined entity at about $2 billion, the companies said. The merger with Athena, a women-led SPAC that raised $250 million in its initial public offering in March, will generate $415 million of proceeds for the combined company. The proceeds include a $165 million private investment in public equity, or PIPE, from investors such as Morgan Stanley's investment arm Counterpoint Global, Salient Partners and Saba Capital.

• dMY Technology Group Inc IV: Earth data and analytics company Planet Labs, which is backed by Alphabet's Google, will go public through a merger with a blank-check company in a deal valued at $2.8 billion, the companies said. Planet Labs will merge with dMY Technology Group and list on the New York Stock Exchange. Planet Labs will invest proceeds from the deal to speed up growth, including expansion into existing and new markets and offer new products, it said. The company, which generates revenue mainly through a subscription-based model, said its services are used by over 600 customers in 65 countries.

• Welbilt Inc: The U.S. food-service equipment maker said on Tuesday Italian rival Ali Group's revised takeover bid was superior to its existing tie-up agreement with Middleby and that it plans to move ahead with the offer. Welbilt said it notified Middleby of its intention to terminate their merger agreement. Ali Group, which operates worldwide and supplies food-service equipment to businesses ranging from hotels to schools and supermarkets, had made an offer of $23 per share in May, but revised its bid to $24 apiece on Monday, valuing Welbilt at $3.41 billion. This trumps a $2.9 billion all-stock offer for Welbilt by U.S. competitor Middleby.

In Other News

• American Airlines Group Inc: The U.S. air carrier said on Tuesday it carried nearly 2.7 million customers on more than 26,000 flights from July 1 through July 5, nearly three times the passengers it carried in 2020. The company flew more than twice as many flights over the five-day period this year versus 2020 including combined mainline and regional flights as more Americans get vaccinated against COVID-19. "After a challenging year, this weekend proved that people are ready to travel again and that the American team stands ready to deliver," American chief operating officer David Seymour said in the memo to employees seen by Reuters.

• Comcast Corp: Universal Pictures will send new movies exclusively to the company's Peacock streaming service no later than four months after they debut in theaters, the company said on Tuesday. The new arrangement begins in 2022 and will include films from Universal, animation studios DreamWorks Animation and Illumination, and arthouse division Focus Features. Financial terms were not disclosed. Upcoming titles include "Jurassic World: Dominion," a new movie from "Get Out" filmmaker Jordan Peele, and fresh installments in the animated "Minions" and "Puss in Boots" franchises, a company statement said. The deal between Universal and Peacock covers what the industry calls the "Pay-One" window, the time when movies that have left theaters play on streaming services or cable channels. That period typically lasts 18 months.

• Didi Global Inc: Two Chinese popular mobile apps, Ant's Alipay and Tencent's Wechat, have suspended the light-version software of Didi's ride hailing services in China to new users, a source familiar with the matter said. The service is still available to users who have used them on the platforms before, the source, who declined to be named, said. The light-version platforms, known as mini programmes, are smaller than common mobile apps and exist inside a super, or multifunction app, such as Alipay or Wechat. Didi also operates a standalone app.

• Exxon Mobil Corp: The company and United Steelworkers (USW) said little progress was made in talks on Tuesday between company and union negotiators to end a nine-week lockout of 650 workers at a Beaumont, Texas refinery and lube oil plant. Exxon made counter offers to proposals offered by USW Local 12-243, which represents workers at the 369,024 barrel-per-day (bpd) refinery and adjoining lube oil plant, said Hoot Landry, USW International representative. The USW has said the company’s last proposal requires its members to give up long-standing seniority and would create a separate contract for workers in the lube oil plant from that for workers in the refinery.

• Lloyds Banking Group PLC: The British lender said it has launched its private rental business and aims to buy more than 1,000 residential properties by the end of next year. Under the brand "Citra Living", Lloyds expects to have its first tenants within the next few weeks in Fletton Quays in Peterborough, the company said in a statement, adding that it plans to acquire around 400 properties by the year-end and double the target next year. The move into property rentals, which was reported by the FT earlier this year, highlights the pressure on retail banks to find new revenue sources as profit margins in their core businesses are squeezed by record-low interest rates.

• Nikola Corp: Shareholders of the electric truck maker have voted against a proposal to approve compensation paid to its "named executive officers," including $159.2 million to founder and former executive chairman Trevor R. Milton, the company said on Tuesday. The decision, although non-binding, illustrates shareholders' discontent about Nikola, once a high-flying company whose shares tanked over 80% from its peak partly due to ongoing probes by regulators and prosecutors. The compensation, which includes salary, bonus and stock awards, was proposed to a total of six people, including chief executive officer and president Mark Russell with $159.2 million and Britton Worthen, chief legal officer with $79.6 million. The shareholders' meeting took place on June 30.

• Nomura Holdings Inc: Japan's top brokerage and investment bank plans to suspend part of its cash-prime brokerage business after sustaining a $2.9 billion hit from the collapse of U.S. investment fund Archegos, a person familiar with the matter said. The move comes after Nomura reviewed its prime brokerage business and vowed to enhance risk management in the wake of the Archegos loss. Specifically, Nomura plans to stop prime brokerage services using U.S. and European cash stocks, the source said. The person declined to be identified as the matter was private. The bank will continue cash-prime brokerage services with Japanese and Asia stocks, as well as the prime brokerage business with U.S. stock derivatives, where the bank has strengths, the source said.

• Nvidia Corp: The company said it opened what it claims is the fastest UK supercomputer to outside researchers that include both academic scientists and commercial firms such as AstraZeneca and GlaxoSmithKline. The chip supplier spent about $100 million on its Cambridge-1 system, which uses artificial intelligence to solve health research problems and was announced in October. In the case of AstraZeneca, for example, the system will learn about 1 billion chemical compounds represented by groups of characters that can be assembled into sentence-like structures. "They can use the technology to finetune the molecules for aspects they care about, like binding to proteins or making them safe for human consumption," Kimberly Powell, vice president and general manager of Nvidia's healthcare business, said in an interview.

• Royal Dutch Shell PLC: The Anglo-Dutch energy firm said it will boost returns to shareholders via share buybacks or dividends earlier than expected after a sharp rise in oil and gas prices helped it reduce debt. Shell will increase its distribution to shareholders to 20% to 30% of cash flow from operations beginning in the second quarter, the company said in a trading statement before quarterly results. The move, which comes earlier than many analysts had expected, was due to "strong operational and financial delivery, combined with an improved macroeconomic outlook."

• Sinovac Biotech Ltd: People who received Sinovac shots are excluded from Singapore's count of total vaccinations against COVID-19, officials in the city state said, citing inadequate efficacy data for the Chinese-made vaccine, especially against the contagious Delta variant. "We don't really have a medical or scientific basis or have the data now to establish how effective Sinovac is in terms of infection and severe illnesses on Delta," health minister Ong Ye Kung said during a media briefing. Last month, Kenneth Mak, Singapore's director of medical services, said evidence from other countries showed people who had taken CoronaVac were still getting infected, posing a significant risk. And Singapore has said that people vaccinated with CoronaVac would still need to be tested for COVID-19 before attending certain events or entering some venues, unlike people vaccinated under the national programme.

• Telefonica SA: The Spanish telecoms operator plans to raise as much as 500 million euros with the sale of a minority stake in its technology unit, Cinco Dias newspaper reported, citing financial sources. Telefonica has hired advisor KPMG and investment bank Morgan Stanley and potential buyers include private equity funds such as Apax Partners, the newspaper said. Telefonica is ready to sell up to 49% of the unit, which is initially valued at 1 billion euros. The unit includes cybersecurity, Internet of Things an cloud computing operations, Cinco Dias said. The sale would be part of a wider Telefonica plan to reduce its debt by selling assets.

• Verizon Communications Inc: A lawsuit filed by Chinese telecommunications equipment maker Huawei against Verizon alleging patent infringement is set to begin jury selection today. In February 2020, Huawei sued Verizon in two U.S. District courts in Texas, alleging the company used a dozen Huawei patents without authorization in areas such as computer networking, download security, and video communications, seeking an unspecified amount of compensation and royalty payments. Verizon last year called the lawsuits "nothing more than a PR stunt" and "a sneak attack on our company and the entire tech ecosystem" and filed counterclaims against Huawei, claiming the Chinese company violated Verizon patents.

• Virgin Galactic Holdings Inc: As the company finalizes plans for founder Richard Branson to join five others on a test flight to the edge of space on July 11, the British billionaire said his wife may be nervous about the launch but he himself wasn't the least bit afraid. "I've been looking forward to this for 17 years," Branson said in an interview on Tuesday from Spaceport America near the remote town of Truth or Consequences, New Mexico. Unity will be launched at an altitude of about 50,000 feet from a Virgin Galactic carrier plane, then soar on its own rocket power to the boundary of space, where the crew will experience about 4 minutes of weightlessness before beginning a descent back to Earth.

• Xpeng Inc: The Chinese electric vehicle maker closed flat at its $1.8 billion Hong Kong dual primary listing as the company said it would develop future models based on product platforms designed for international markets. Led by former Alibaba executive He Xiaopeng, the seven year-old automaker is developing smart-car technologies including a smart cabin and autonomous driving. Xpeng chose a dual primary listing rather than a secondary listing as it has been listed in New York for less than two years. The dual primary listing allows qualified Chinese investors to take part through the Stock Connect regime linking the mainland Chinese and Hong Kong markets, according to the exchange's rules.

ANALYSIS

U.S. IPO market a danger zone for Chinese firms after Beijing crackdown

China's stepped-up scrutiny of overseas listings by its companies and a clampdown on ride-hailing giant Didi soon after its debut in New York have darkened the outlook for listings in the United States, bankers and investors said.

ANALYSTS' RECOMMENDATION

• Alkaline Water Company Inc: Canaccord Genuity cuts rating to sell from hold, believing the company’s recent share price appreciation is overdone.

• Beyond Meat Inc: CFRA cuts rating to hold from buy, to reflect a more balanced risk/reward following a 30%+ increase in share price over the past two months.

• Exxon Mobil Corp: JPMorgan cuts target price to $74 from $76, citing the company’s heavier planned maintenance impacts.

• Nice Ltd: RBC raises rating to outperform from sector perform, factoring the company’s market opportunity, competitive differentiation, attractive financial model, blue chip customer base, and compelling valuation.

• Oasis Petroleum Inc: RBC raises rating to outperform from sector perform, based on the company’s rapid progress to simplify the structure, solid operational execution, and demonstration of peer leading shareholder returns.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 (approx.) JOLTS job openings for May: Expected 9.388 mln; Prior 9.286 mln

1300 Overall comprehensive risk for Q3: Prior 8.26

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0830 MSC Industrial Direct Co Inc: Q3 earnings conference call

0900 W R Grace & Co: Annual Shareholders Meeting

1500 Sundial Growers Inc: Annual Shareholders Meeting

1700 WD-40 Co: Q3 earnings conference call

EX-DIVIDENDS

Hibbett Inc: Amount $0.25

Ingles Markets Inc: Amount $0.16

Roper Technologies Inc: Amount $0.56

Trinseo SA: Amount $0.08

Poging tot correctie maar de Nasdaq wil nog niet mee

Het woord van de afgelopen periode op de beurzen is "divergentie" en dat hebben we gisteren weer duidelijk kunnen zien. Door de divergentie blijven beleggers veel vertrouwen houden, te veel zelfs, zodat dips bij andere sectoren snel worden opgekocht. Het is wachten tot het moment dat alle sectoren 1 richting gaan kiezen en dan kan het snel 3 tot 5% lager staan. Ik verwacht nog steeds een terugval en op redelijk korte termijn, we hebben gisteren gezien dat als het omlaag gaat het ook heel snel gaat.

Update 7 juli:

De Dow Jones verloor 0,6% terwijl de S&P 500 zo'n 0,2% verloor, de Nasdaq daarentegen wist de plus nog vast te houden en zet een nieuw record neer, de index won 0,2% en dat kwam vooral door de stevige stijging van Amazon, het aandeel won maar liefst 4,7% en zet zo een nieuw record neer. Ook Apple en Afphabet sluiten met een redelijke plus. Er was amper nieuws om de markten fors te laten bewegen maar in een periode als nu zien we vaker grotere bewegingen door het gebrek aan volume.

Europa had het wat moeilijker gisteren, de DAX moest 150 punten inleveren terwijl de AEX 2,5 punten lager sloot. De Franse CAC 40 verloor 90 punten. De AEX deed het ook nu weer wat beter dan de DAX en de CAC 40, de AEX verloor slechts 0,35% terwijl de andere 2 dicht bij 1% verlies afsluiten.

Dat het na de recente rally tijd wordt voor een adempauze is niet meer dan normaal maar dan moeten wel alle sectoren een keer dezelfde richting kiezen en dat is momenteel moeilijk gezien er telkens weer divergentie is. Zoals ik al aangaf zit er al een behoorlijke portie goed nieuws in de koersen verwerkt waardoor het in feite moeilijker gaat worden om vanaf hier veel hoger te geraken.

Wat ook opviel is dat de olieprijs ruim 2% omlaag ging na eerst een goeie procent hoger te hebben gestaan wat dan weer de hoogste prijs was in 6 jaar tijd. Het OPEC-kartel wist maandagavond nog altijd geen akkoord te bereiken over nieuwe productie afspraken. De olie kan blijven bewegen de komende periode en dat in beide richtingen.

Vanaf volgende week krijgen we de Amerikaanse banken met hun cijfers over het 2e kwartaal, dan start het cijferseizoen en kunnen we weer elke dag uitkijken naar wat bedrijven hebben gepresteerd de afgelopen periode. Tot nu toe waren alle recente kwartalen beter dan verwacht, nu de markten weer een etage hoger staan kijken we uit hoe de markt de cijfers zal beoordelen.

Nieuwe mogelijkheden komen er aan:

We blijven in ieder geval zoeken naar nieuwe mogelijkheden om op de handelen met wat indices, donderdag werden er al wat kleine posities opgenomen en er kan mogelijk nog een positie bij komen deze week. Eerst maar eens zien wat de markt gaat doen nu alles rond de hoogste standen ooit staat.

Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding die loopt tot 1 september ...

Maand JUNI werd afgerond met een mooie winst:

De maand juni zit erop het werd al de 7e maand op rij dat alle abonnementen de maand met winst afronden en dat in toch een redelijk moeilijke markt. Ik zal ook deze maand met voorzichtig handelen resultaat te behalen, u kunt meedoen door lid te worden.

Bij Guy Trading kijk ik ook naar wat aandelen waar ik iets mee kan doen. Schrijf u dus op tijd in, ik zal in ieder geval het momentum kiezen om in te stappen.

Maak nu gebruik van de nieuwe aanbieding tot 1 SEPTEMBER voor €39 (Polleke Trading €49) https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JUNI) en dit jaar (2021):

Markt technisch bekeken:

Wat twijfels rondom de economie en dan vooral via de traditionele sectoren liet de markt gisteren wat gas terug nemen. Er was wel opnieuw divergentie te zien tussen de traditionele sectoren en de technologie aandelen. Vooral de grote 5 vielen op met een stijging en dat zet meteen de Nasdaq hoger met een nieuw record. De andere indices moesten inleveren al la het slot er wat beter bij dan waar de indices gedurende de sessie hun bodem hebben neergezet.

We zitten in een fase met nieuwe records of er dicht bij waardoor de ene index de andere daarin meetrekt. De meer traditionele indices zoals de Dow Jones op Wall Street en de DAX hier in Europa hebben het daar moeilijk mee. Het blijft wel opletten met deze divergerende markten, dan kan niet zo blijven en op een gegeven moment zal alles zich in dezelfde richting bewegen. We staan hoe dan ook met alles hoog en dicht bij de records dus de kans op een grotere daling blijft volgens mij het gevolg. Technisch blijft alles nog sterk en is het wachten op het sein dat de indices een 3 tot 5% correctie kunnen inzetten, we zitten er niet zo ver meer vanaf nu.

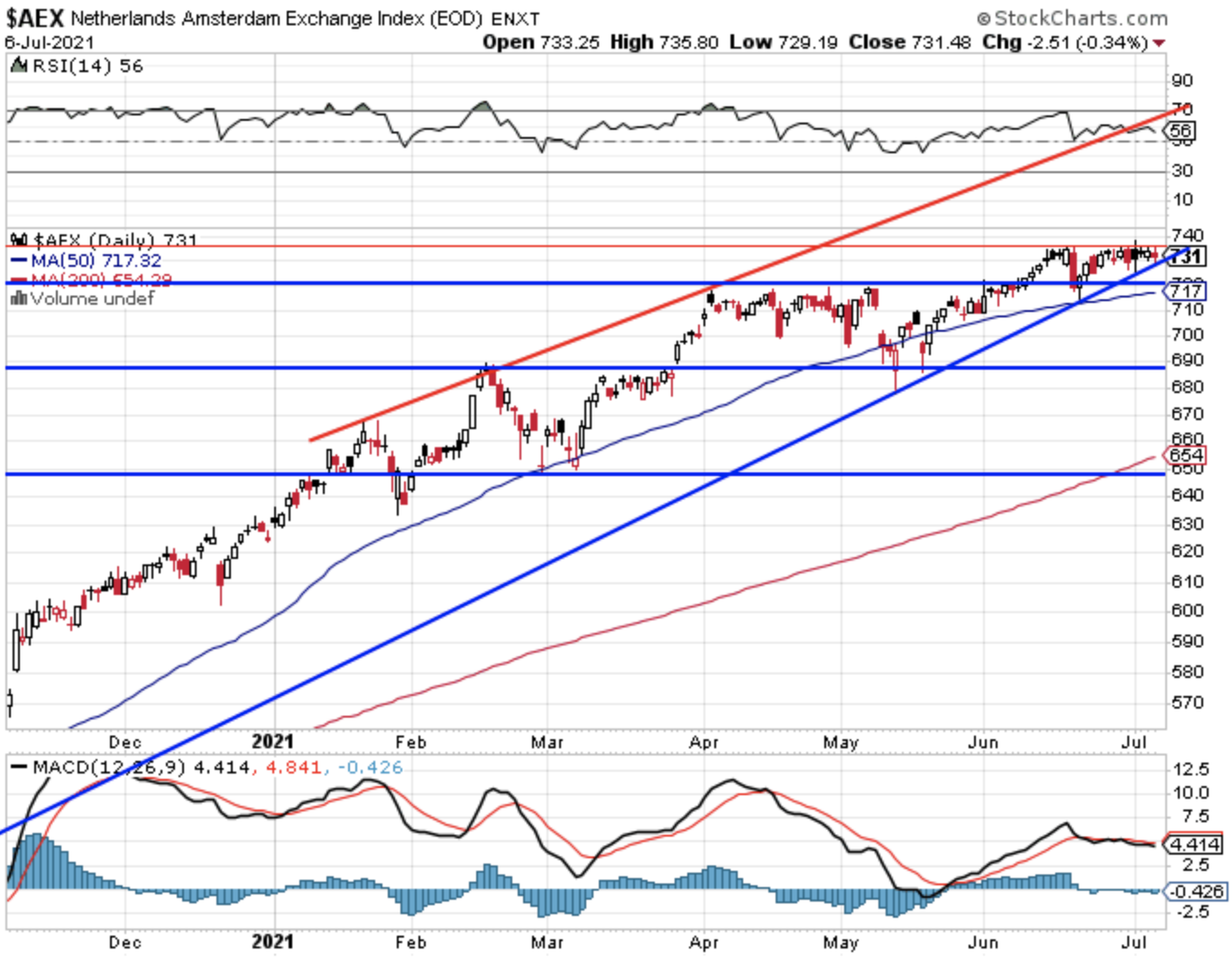

Technische conditie AEX:

De AEX test opnieuw de top maar moest weer inleveren na de opening van Wall Street, de index sluit wat lager en zien duidelijk dat de index veel moeite heeft om die 736 punten te doorbreken en dat al enkele sessies na elkaar.

Weerstand nu het record op 736 punten met net daarboven de top op 738 punten, later de 745 en daarna moeten we al letten op de 750 punten. Steun nu eerst de 726-727 punten waar we de bodem van vorige week zien, later de bekende zone 717-719 punten waar de oude top wacht, rond die steun komt nu ook het 50-daags gemiddelde uit. De komende dagen worden belangrijk voor de AEX index, onder de steunlijn ligt er dus ruimte tot rond die 717-719 punten.

Technische conditie DAX:

De DAX moest weer inleveren na een nieuwe poging richting de top waar de index maar niet naartoe wil. De index sluit nog wel net boven de 15.500 punten maar met moeite nadat Wall Street via de traditionele indices moest inleveren. Steun blijft de 15.500-15.550 punten zone die nog net werd vastgehouden, onder die 15.500 en vooral onder de bodem van gisteren rond de 15.460 punten, ziet het er slecht uit. De index lijkt ook klaar te staan om te draaien naar omlaag.

Weerstand nu de 15.650 punten, later de top op 15.802 punten. Bij een. uitbraak zien we weerstand rond de 15.900 en de 16.000 punten. Steun blijft uiteraard de zone 15.500-15.550 punten, later de 15.460 punten waar nu ook het 50-daags gemiddelde uitkomt. Verder zien we steun rond de laatste bodem op 15.310 punten.

S&P 500 analyse:

De S&P 500 moet wat inleveren maar sluit wel ver boven de laagste stand van de sessie, de index sluit slechts 9 punten lager na even zo'n 38 punten lager te hebben gestaan. De S&P blijft dicht bij de hoogste stand ooit die rond de 4355,40 punten wacht. Weerstand nu die top rond de 4355 punten, later richten we ons op 4375 en de 4400 punten.

Steun wordt nu eerst de 4290 punten met daaronder de 4237 punten waar de oude top uitkwam, later de 4211 punten waar nog steeds zowel de steunlijn onder de bodems samen met het 50-daags gemiddelde uitkomen, pas onder deze steun moeten we opletten.

Analyse Nasdaq:

De Nasdaq werd vooral gestuwd door Amazon gisteren, het aandeel won fors (4,7%) en zet zo een nieuw record neer. De rest verloor amper of kon wat winst boeken zodat deze index een plus kon neerzetten terwijl de rest ofwel de andere sectoren het moeilijk kregen. Een nieuw record op slotbasis zien we nu op 14.687 punten, op slotbasis ook een record dat nu uitkomt op 14.663 punten.

De eerste weerstand wordt nu de 14.687 punten, later de 14.750 en de 14.850 punten, zolang de flow erin blijft weten we niet waar het zal stoppen maar als er winst wordt genomen gaat het ook snel en dat hebben we gisteren ook kunnen zien. Steun nu de 14.530 punten met daaronder de 14.350 en de 14.211 punten (oude toppen). Pas onder die 14.211 punten ziet het er snel slechter uit, eerst maar eens zien waar de Nasdaq de komende dagen naartoe wil.

Euro, olie en goud:

De euro zien we nu rond de 1,183 dollar, de prijs van een vat Brent olie komt uit op 74,6 dollar terwijl een troy ounce goud nu op 1800 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart

TA Ahold, RD, Goud, Signify, AEX en Prosus

Uit bed gevallen dus ik ben er vroeg bij! Er komen vandaag 6 grafieken voorbij en van alle zes gaan we de technische conditie bekijken. Eén index, een edelmetaal en vier aandelen waaronder Koninklijke Olie en Signify. Ik stel voor dat we maar direct beginnen met het eerste plaatje.We beginnen met…

Lees verder »